25 Best Alternative Data Providers for Credit Decisions

Discover 25 leading alternative data providers helping lenders improve credit decisions, detect fraud, and serve borrowers beyond traditional scoring.

.webp)

Around the world, 1.4 billion people can't get loans because they don't fit into the traditional scoring models. That's almost 20% of people worldwide who are left out.

In response to this challenge, more lenders are turning to alternative data for credit scoring. It goes far beyond borrowers' credit histories.

In this article, you'll find a list of alternative data providers that can give you a more detailed view of your customers and lead you to potentially lower risks and higher opportunities.

What is alternative data?

Alternative data is information coming from outside traditional credit reports and financial documents.

It gives lenders extra ways to understand a borrower’s financial behavior.

Examples include rent and utility payments, phone usage, or even online activity.

This data helps make fairer and more accurate lending decisions.

Key alternative data market stats

North America holds the largest share of the alternative data market, driven primarily by the U.S.'s mature digital infrastructure.

High smartphone penetration, widespread use of digital payments, and an active eCommerce landscape all contribute to the rich data environment.

Financial institutions and hedge funds in the region are also early adopters of tech, working with top alternative data companies to gain faster, deeper insights into consumer and market behavior.

This strong demand, combined with a culture of innovation, keeps North America at the forefront of the alternative data market.

Asia Pacific is emerging as the fastest growing region. It’s fueled by rapid digitization, rising mobile usage, and expanding fintech ecosystems across India, China, and Southeast Asia.

Top alternative data providers for the lending industry

We relied on specific criteria to compile a list of alternative credit data providers. In our view, such providers should:

- Offer products based on alternative data

- Focus on credit risk assessment use cases

- Enhance scorecard performance

- Help lenders decide between high-risk and reliable clients

Based on our analysis, we’ve highlighted 25 alternative credit data providers that meet these standards.

-

#1. RiskSeal

Description: RiskSeal is a powerful alternative data provider delivering clients access to over 400 data points collected from 200+ unconventional sources. The solution strengthens credit scoring models by analyzing the digital footprint of potential borrowers.

Website: https://www.riskseal.io/

Founded: 2022

Alternative data the company provides:

- Real-time Digital Credit Score

- Photo matching

- Name intelligence

- Location insights

- Behavioral metrics

- Risk analysis

- Trust score

- Email data enrichment

- Email address analysis

- Phone data enrichment

- User social media search

- IP analysis

Cost: Starting from $499/month, flexible pricing policy, pay-as-you-go model, no additional integration fees, support and training included.

Trial period: Free PoC is available.

#2. LenddoEFL

Description: LenddoEFL is a scoring system that utilizes artificial intelligence, machine learning, and predictive analytics to analyze both traditional and alternative data. The company positions itself as a market leader in psychometric data, which is used to assess the creditworthiness of borrowers.

Website: https://lenddoefl.com

Founded: 2011

Alternative data the company provides:

- Non-traditional data from various sources, including social media data, smartphone metadata, online shopping behavior, email and SMS data, web browsing history, GPS location data, etc.

- Psychometric and biometric data—personality assessment, cognitive ability tests, and skills evaluations.

Cost: There is no publicly available information regarding pricing. You must fill out the feedback form on the website to obtain information about tariffs.

Trial period: Data not available.

#3. Rubix

Description: Rubix is an analytical platform that helps mitigate credit risks, build a secure supply chain, and monitor compliance with requirements for platform users in India and worldwide.

Website: https://rubixds.com/

Founded: 2017

Alternative data the company provides:

- Structured data from financial statements and open databases.

- Unstructured data from over 200 sources, including data on retail sales, Point-of-Sale (POS), social media, mobile location, satellite imagery, supply chain, and consumer demographic.

- Pre-defined risk analytics with scores, indices, and estimations.

Cost: Customized pricing; you should contact a manager for details.

Trial period: Data not available.

#4. Plaid

Description: Plaid is an alternative data provider that allows assessing potential clients' banking transactions, incomes, and expenses.

Website: https://plaid.com

Founded: 2017

Alternative data the company provides:

- Unclassified and classified transactions from personal accounts spanning over 5 years.

- Balance information.

- Account identification details.

Cost: Two pricing plans: free and custom.

Trial period: Available.

#5. credolab

Description: credolab is a platform that enriches scoring models with alternative data for risk assessment, fraud detection, and improving marketing campaigns.

Website: https://www.credolab.com/

Founded: 2016

Alternative data the company provides:

- Smartphone metadata and web behavioral data, including call and SMS, location, and social media data.

- Analytics and personality assessment based on web behavioral data.

Cost: Starting from $600/month.

Trial period: A 30-day free access available.

#6. IDology

Description: IDology is a platform that offers solutions for verifying consumer identities at the point of transaction, helping to prevent fraud, reduce costs, and ensure regulatory compliance.

Website: https://www.idology.com/

Founded: 2003

Alternative data the company provides:

- Government and private data sources, including device, phone number, email intelligence, social media, and geolocation data.

- Authentication of identity documents through access to identity document verification data, confirming the authenticity of identification.

- Identification of individuals through their appearance (selfie ID verification) using digital identity verification data.

Cost: Pricing offers are tailored individually. You need to contact a manager to find out the price.

Trial period: Available. You need to contact a manager for details.

#7. MicroBilt

Description: The MicroBilt platform provides users with alternative data and predictive algorithms to assess the creditworthiness of their clients or partners across various industries.

Website: https://www.microbilt.com/

Founded: 1978

Alternative data the company provides:

- Data on periodic payments such as utility, rental, and telecom payments.

- Financial information such as savings account data.

- Alternative data from other sources, including property and business ownership data, criminal, eviction, and bankruptcy records, judgment, employment history, vehicle registration, and address history data.

Cost: Available by subscription, with prices depending on the volume of services provided.

Trial period: Available; you should contact a manager for details.

#8. ArkOwl

Description: ArkOwl is a platform that enables real-time verification of email addresses and phone numbers. The platform provides clients with raw data, based on which they can assess the reliability of any user.

Website: https://arkowl.com/

Founded: 2012

Alternative data the company provides:

- Data points from social networks, email providers, domain databases, and other public data sources.

- A range of user information, including the date the email account was created, the real owner's name, known nicknames, and registration status.

- Simultaneous real-time verification of thousands of email addresses and phone numbers with the ability to consolidate all information into a single profile to obtain complete information about any recipient.

Cost: The platform offers several payment options: monthly subscription, upfront payment, or pay-as-you-go model.

Trial period: Available – registration required.

#9. Dana

Description: Dana is a tool designed for e-commerce platforms, enabling them to offer users instant loans through a digital lending platform.

Website: https://dana.money/

Founded: 2021

Alternative data the company provides:

- Digital footprint of potential borrowers, including device metadata.

- Information from SMS transaction alerts.

Cost: You need to contact a manager for information regarding the cost of services.

Trial period: No information is available on the official website.

#10. Monnai

Description: Monnai is a solution for fintech companies that use AI for the analysis of disparate customer data, identification, and online behavior assessment.

Website: https://monnai.com/

Founded: 2021

Alternative data the company provides:

- Telecommunications data, email usage information, IP address data, and consumer behavior on the Internet.

- Analysis of digital footprints of users on over 40 global and local websites.

Cost: Flexible pricing policy.

Trial period: Available.

#11. FinScore

Description: FinScore is a fintech company that specializes in alternative credit scoring based on the analysis of telecom service provider data.

It operates in the Philippines and Indonesia. It uses Artificial Intelligence and Machine Learning to assess the creditworthiness of borrowers.

Website: https://www.finscore.ph/

Founded: 2018

Alternative data the company provides:

- Telecommunication data, which includes call duration, geolocation, mobile phone costs, SIM card age, payment model (prepaid or postpaid), etc.

- Alternative data from other sources, which include email address and social media.

- Information on previous loan applications from 40+ financial organizations.

Cost: SUPERFLEXI and DISCOVERY tariff plans are available to users. The cost is available on request. It is also possible to develop a personalized tariff plan.

Trial period: All pricing plans include access to Proof of Concept and Historical Backtesting.

#12. LexisNexis Risk Solutions

Description: LexisNexis Risk Solutions is a provider of alternative data for companies that operate in various industries, including financial services, insurance, public administration, and others.

The company specializes in analytics, risk forecasting, and fraud prevention.

Website: https://risk.lexisnexis.com/

Founded: 1994

Alternative data the company provides:

- Public records

- Identity insights

- Stability insights

- Address insights

- Alternative credit seeking insights

- Asset insights

Cost: Complex pricing structure. Search fees range from $0 to $469. Combined searches from more than one source are priced individually.

Trial period: Available.

#13. Trusting Social

Description: The Trusting Social platform provides AI-based tools for lending institutions to manage credit risk, attract, assess creditworthiness, and identify potential borrowers.

The company provides services in India, Indonesia, Vietnam, and the Philippines.

Website: https://trustingsocial.com/

Founded: 2013

Alternative data the company provides:

- Telecommunications data.

- Facial recognition, including comparison of selfies and images in national identity cards with avatars in social media and public databases.

- Alternative credit rating.

- Fraud rating.

Cost: Customized pricing.

Trial period: There is no free trial.

#14. Zest AI

Description: Zest AI – an American technology company that offers users an Artificial Intelligence-based platform to create customized credit scoring models and predict risk.

Website: https://www.zest.ai/

Founded: 2009

Alternative data the company provides:

- Cash flow information, including utility and rent payments and mobile operator fees.

- In addition to standard credit bureau data, they conduct more thorough analyses. For example, their scoring models consider factors such as the duration of delinquencies and the intervals between payment schedule violations.

Cost: Zest AI customizes its pricing. To get a quote, the customers have to arrange a consultation or demo with their team.

Trial period: Free trial not available. A demo version can be requested.

#15. CreditXpert

Description: CreditXpert specializes in improving the credit ratings of borrowers interested in mortgage lending.

The platform uses alternative data to assess the creditworthiness of applicants, develops a plan for them to improve their rating, and allows lenders to offer personalized loan terms to each of them.

Website: https://creditxpert.com

Founded: 2001

Alternative data the company provides:

- Rent

- Utility bills

- Cell phone bills

Cost: From $99.

Trial period: There is no free trial period. There are two demo options – a pre-recorded video and an interactive option.

#16. AdviceRobo

Description: AdviceRobo is an AI-based platform specializing in advanced decision-making in marketing and lending. It allows for comprehensive tracking and evaluation of potential risks using dynamic financial analytics.

Website: https://advicerobo.com/

Founded: 2013

Alternative data the company provides:

- Open banking data

- Digital footprints

- Psychometric profiles

Cost: Customized pricing

Trial period: A free 30-day trial period is provided.

#17. AperiData

Description: AperiData is a platform that its creators position as a real-time credit bureau. It specializes in risk analytics and credit scoring for financial organizations.

Website: https://www.aperidata.com/

Founded: 2017

Alternative data the company provides:

- Customer account data

- Information about obligations, transactions, assets, income, and expenses

- Risk identifiers

- Identity verification

Cost: No publicly available information. Consultation required.

Trial period: Not provided, but you can book a demo.

#18. APLYiD

Description: APLYiD is a platform for compliance with AML (Anti-Money Laundering) and KYC (Know Your Customer) policies. It uses biometric identification and data verification technologies to verify clients for companies in the legal, real estate, and accounting industries.

Website: https://www.aplyid.com/

Founded: 2018

Alternative data the company provides:

- Global government databases

- Identification of Politically Exposed Persons (PEP)

- Sanctions list check

Cost: Four pricing plans are available. For pricing details, you should contact a manager.

Trial period: Available.

#19. Atto

Description: Atto is a fintech company that helps lending organizations make credit decisions and manage their portfolios using alternative data. It specializes in serving businesses and consumers who suffer from insufficient financial inclusion.

Website: https://www.atto.co/

Founded: 2011

Alternative data the company provides:

- Information about bank accounts

- Income, expenses, and transactions of clients

- Signs of financial difficulties

- Information about credit obligations and deposits

Cost: No publicly available information. Consultation required.

Trial period: Not provided, but you can book a demo.

#20. Basiq

Description: Basiq is an open banking API platform. It provides its clients with tools for aggregating consumer financial information and data analytics.

Website: https://www.basiq.io/home.html

Founded: 2016

Alternative data the company provides:

- Account and transaction history

- Information about income and expenses

- Information about obligations and assets

Cost: Calculated individually. Fees apply for access to the platform and additional charges depending on the functionality used.

Trial period: Not provided.

#21. AccountScore

Description: An analytics provider that helps businesses obtain, enrich, and understand bank transaction data. Its solutions enable clients to analyse bank accounts individually or at scale. AccountScore is mostly used for credit modelling, affordability assessment, tenant verification, and marketing profiling.

Website: https://accountscore.net

Founded: 2015

Alternative data the company provides:

- Detailed bank account transaction data

- Predictive behavioural data (spending patterns, account usage frequency, etc.)

- Affordability and disposable income calculations

- Salary and employment verification

- Tenant income and rental payment history

- In-depth financial profiling and account forecasting

Cost: No publicly available information. Consultation required.

Trial period: Not provided, but clients can request demos and API access.

#22. Jumio

Description: An AI-powered digital identity solution, providing contextual insights throughout the customer lifecycle. The platform combines biometric verification, liveness detection, AML screening, and real-time risk intelligence. It enables enterprises to verify identities with speed and precision.

Website: https://www.jumio.com

Founded: 2010

Alternative data the company provides:

- Biometric and liveness detection data (face recognition, deepfake detection, age estimation, morphing/spoofing signals)

- Global sanctions, PEPs, and adverse media screening

- Identity verification signals from 5,000+ supported global ID types

- Cross-transaction identity intelligence

- End-to-end fraud detection and contextual identity analytics

Cost: Pricing not publicly available. Jumio provides a Total Cost of Ownership Calculator. It estimates costs based on verification volumes, manual review rates, staffing costs, and customer abandonment impact.

Trial period: Not publicly provided, but demos are available upon request.

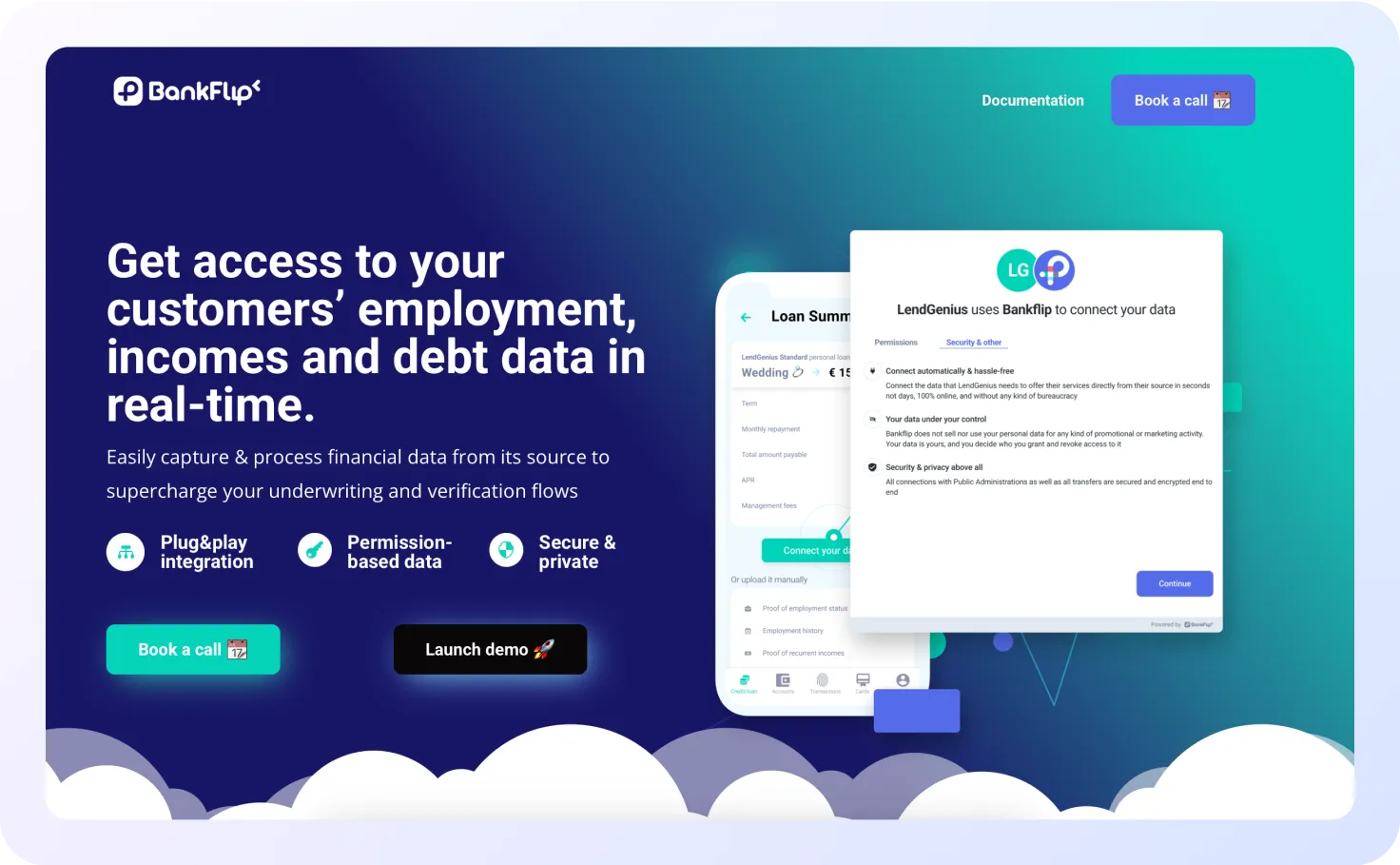

#23. BankFlip

Description: A platform providing access to customers’ employment, income, and debt data. A plug-and-play integration helps streamline underwriting, verification, and risk assessment. BankFlip’s permission-based approach ensures transparency while covering all income sources.

Website: https://www.bankflip.io

Founded: 2019

Alternative data the company provides:

- Verified income data (salary, pensions, unemployment, retirement)

- Employment data (status, employer, continuity of work)

- Debt and risk data

- Income from real estate assets

- Investments and capital gains income

- Business profits and other sources (including crypto and inheritance)

Cost: No publicly available information. Consultation required.

Trial period: Not provided, but clients can book a demo and test the live widget.

#24. ComplyAdvantage

Description: This is an AI-driven anti-money laundering (AML) risk detection company. Its SaaS platform unifies customer and company screening, ongoing monitoring, and transaction analysis. It also incorporates alternative data to enrich insights.

Website: https://complyadvantage.com

Founded: 2014

Alternative data the company provides:

- Sanctions and watchlists data on individuals, companies, and entities

- Politically Exposed Persons and Relatives & Close Associates databases

- Global adverse media monitoring in multiple languages

- Transactional risk intelligence (AML flags, fraud detection, clustering)

- Company and customer risk profiling for onboarding and ongoing monitoring

Cost:

- Starter plan: From $99.99/month for up to 1,000 monitored entities with screening and monitoring features.

- Enterprise plan: Price on application (POA) for unlimited usage with full compliance suite.

Trial period: Not publicly provided. Businesses can sign up directly for the Starter plan or request an Enterprise demo.

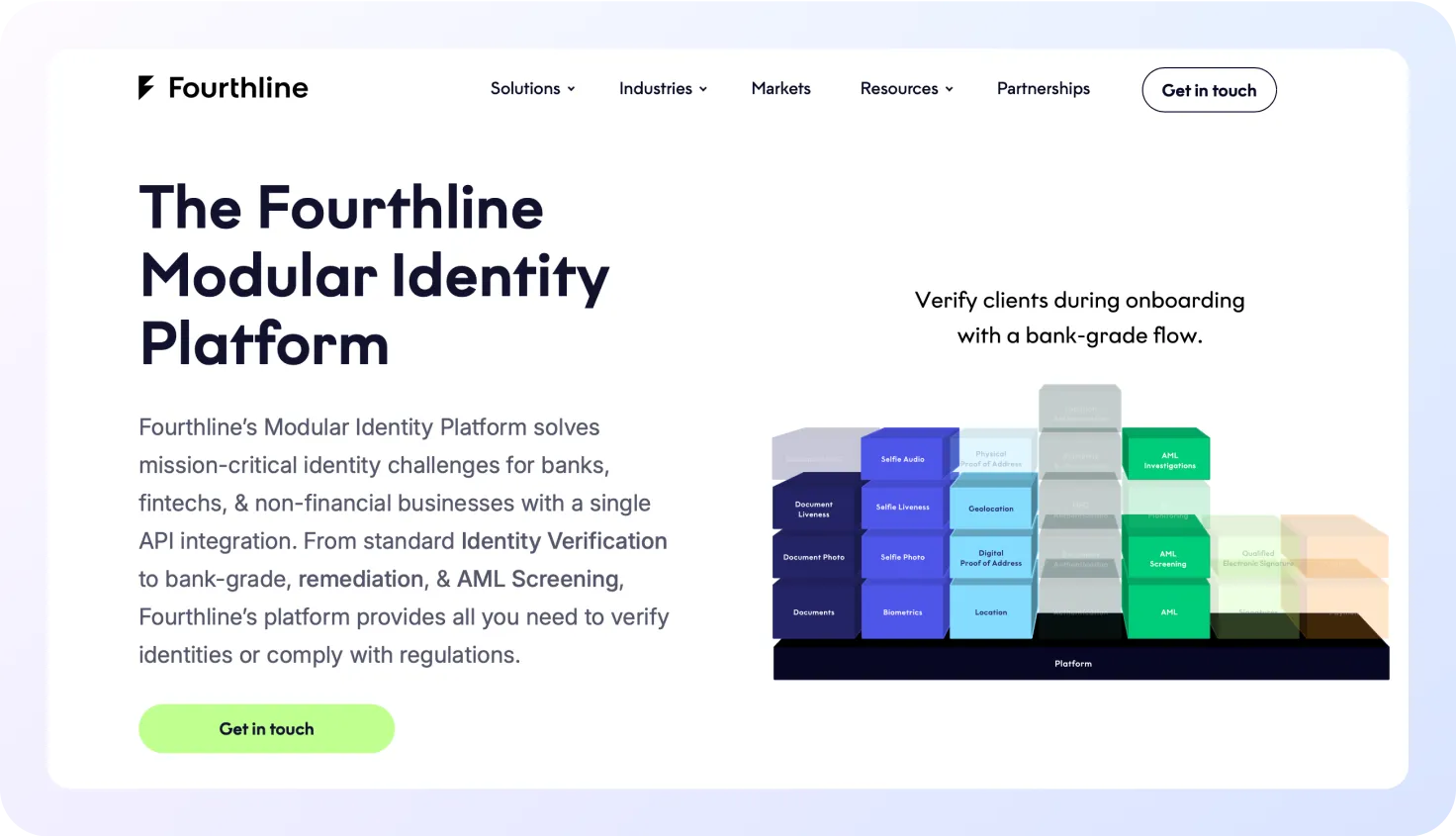

#25. Fourthline

Description: A Modular Identity Platform helping businesses solve identity and compliance challenges. Users can choose from standalone solutions or combine verification, authentication, and AML monitoring. It also delivers bank-grade KYC and fraud prevention.

Website: https://fourthline.com

Founded: 2017

Alternative data the company provides:

- Identity verification (biometrics, document checks, device and location data)

- Digital proof of address and bank account verification

- AML screening and monitoring (including sanctions, PEPs, and adverse media)

- Client authentication and re-KYC for regulatory compliance

- Investigations and CDD reporting

- Qualified electronic signatures and fraud risk indicators

Cost: No publicly available information. Consultation required.

Trial period: Not provided, but businesses can request demos and tailored solution consultations.

Summary

Managing credit risks using alternative data offers numerous advantages for lenders.

It allows them to extend services to individuals with limited or no credit history.

This approach helps spot fraud and identify potential defaulters right at the application stage.

Want to learn more? Book a consultation with RiskSeal to see how we can help grow your lending business.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

FAQ

What is alternative data and how can it benefit the lending industry?

Alternative data refers to non-traditional sources of information that lending organizations use to gather additional insights into borrowers.

Its utilization allows lending organizations to expand their target audience by offering loans to demographics without credit history or those underserved by banking services.

Moreover, alternative data enables lenders to make more informed decisions on loan applications, thus reducing default risks.

What is the current state of the alternative data market?

The current volume of the alternative data market stands at $11 billion and is annually increasing. It is forecasted to demonstrate a CAGR of 52.1% over the next six years, reaching $135.8 billion by 2030.

How can alternative data help with credit risk reduction?

Alternative data provides lenders with a more comprehensive view of borrowers' creditworthiness.

Alternative data providers offer information that allows concluding potential clients' financial status based on factors like subscription payments, timeliness of rent and utility payments, online consumer behavior, etc.

What are the best alternative data providers for the lending industry?

While there are many alternative data providers in the market, most of them cater to organizations across various industries.

RiskSeal, as an alternative data provider, exclusively focuses on credit risk management, deeply understanding the specifics of lending businesses. The company offers lenders an innovative solution to enrich their scoring models with alternative data.

What types of alternative data does RiskSeal offer?

RiskSeal offers a suite of alternative data types designed to analyze digital footprints for credit risk assessment.

These include:

Behavioral metrics, which analyze user interaction patterns.

Trust score - a composite metric assessing user trustworthiness

Email and phone data enrichment, which enhances user identity information.

User social media search, for insights into a user's online presence.

IP analysis, which examines the geographical and network attributes of user connections.

Photo matching and name intelligence for verifying the authenticity of user-submitted names and images.

Together, these tools provide a comprehensive picture of user behavior and authenticity.

Is using alternative data compliant with regulations like GDPR or CCPA?

The use of alternative data in credit scoring must comply with regulations such as GDPR, CCPA, and other similar laws that apply in the specific region.

The responsibility for compliance lies with the lending organization. This includes ensuring the secure use and storage of user data.

Which industries benefit most from alternative data?

Lending organizations benefit the most from the use of alternative data. It is applied in the credit scoring process and allows for lending to unbanked populations, reducing fraud levels, and identifying potential defaulters.

How do lenders integrate alternative data with existing credit models?

Once a lender partners with an alternative data provider, the next step is to update and enrich their existing credit scoring models. This integration is typically carried out according to the lender’s internal processes and regulatory considerations.

After implementation, it's critical to evaluate the performance of the enhanced models by comparing them against traditional credit assessment methods. Metrics such as predictive power, approval rates, and default risk are commonly analyzed.

Finally, based on these insights, the lender decides whether to adopt the alternative scoring approach more broadly and establish a long-term partnership with the data provider.

.svg)

.webp)