Alternative Data for Credit Providers in Malaysia

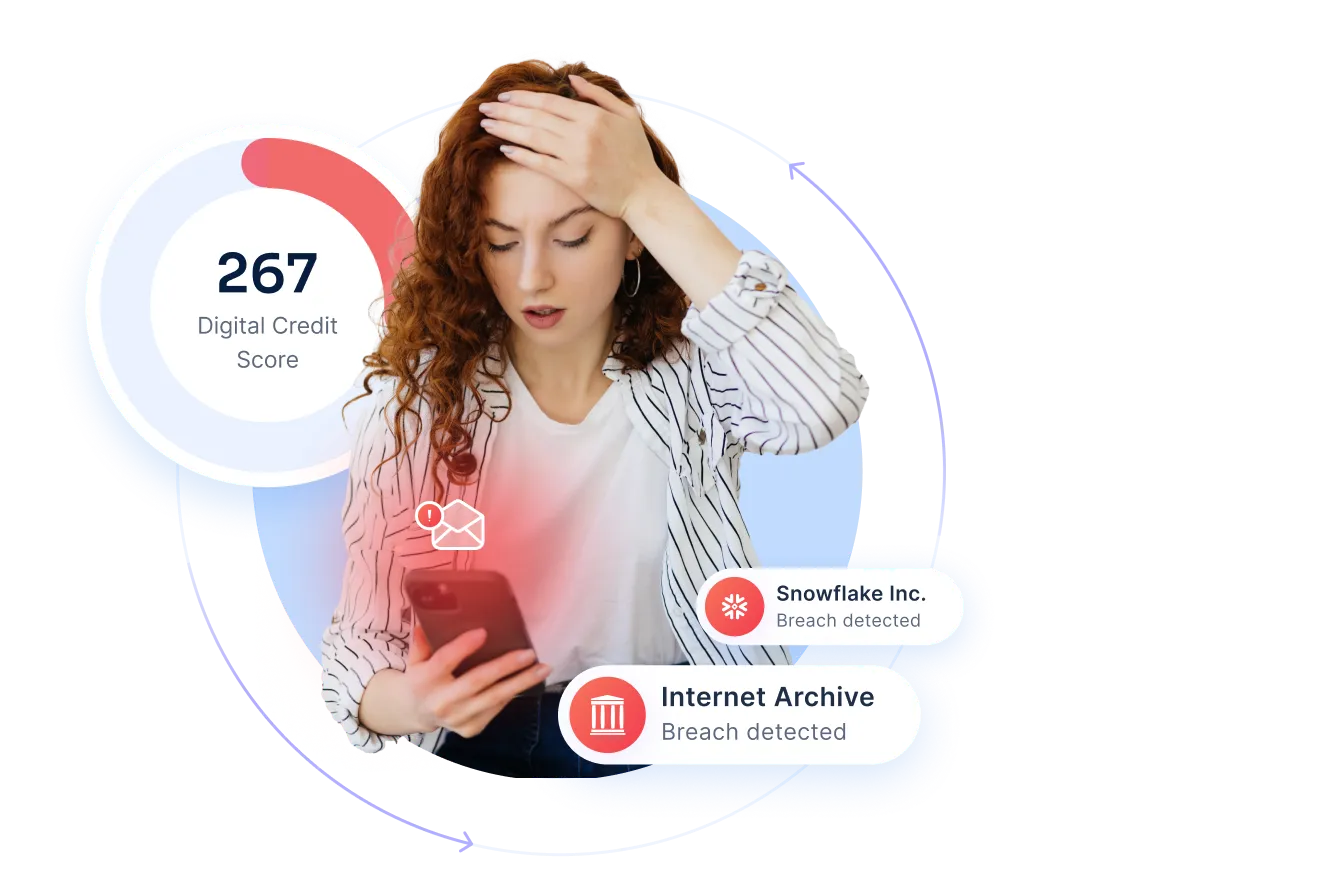

Enhance your credit scoring in Malaysia with local service insights that go beyond credit bureau data. RiskSeal provides 400+ data points to power more accurate decisions.

.webp)

Local Malaysian services for

digital footprint analysis

We collect data from 200+ digital platforms, including Malaysia-specific services.

Below is a list of popular Malaysian online platforms used in RiskSeal scoring. To access

the full selection, which includes niche and regional services, please contact our team.

Shopee

Lazada

Zalora

Applying alternative data for better lending decisions

Clients success stories

See how RiskSeal’s unique data sources generate pure Gini uplift, even in emerging markets. Real numbers. Real before/after performance.

FAQ

What is the price of the RiskSeal solution for Malaysian lenders?

RiskSeal offers flexible pricing based on the plan that fits your needs:

Basic plan. Priced at $499/month, this option is ideal for smaller fintechs with lower transaction volumes.

Custom plan. Built for larger organizations, this plan is tailored to match your transaction volume and business goals.

Want to find the right fit and just learn more about RiskSeal? Check out our pricing page or get in touch with our sales team.

What benefits does RiskSeal provide to its clients in Malaysia?

RiskSeal brings key benefits to clients in Malaysia, including:

- 99.9% API uptime for reliable, uninterrupted performance.

- Always-on technical support to address issues anytime.

- Expert guidance to help you understand and act on data insights.

- Full access to a client portal with powerful analytics to monitor and optimize results.

- Personalized onboarding for a smooth, hassle-free setup.

How can I be sure RiskSeal’s data will improve my company’s processes?

To test if RiskSeal’s scoring fits your goals, you can start with a free Proof of Concept (PoC) using your organization’s historical transaction data.

This allows you to test our digital credit scoring in your real-world environment and explore how it could improve your current models.

Once the PoC is complete, you’ll receive a detailed report showing exactly where RiskSeal adds value, so you can confidently evaluate the impact before moving to full integration.

.avif)

.webp)

.png)

.webp)

.webp)