How Behavioral Insights Are Changing Credit Decisions

Learn key behavioral data types, real-world use cases, and benefits for lenders.

Behavioral insights are becoming essential for credit risk assessment, driving demand for analytics solutions.

This demand is fueling behavior analytics market growth from $1.1 billion in 2024 to $10.8 billion by 2032.

In this article, we explore how behavioral data works in lending and the key patterns that help lenders assess real-world credit risk.

Behavioural data examples in digital lending

Modern credit decisions depend on more than just numbers from a credit bureau.

Behavioral data has become essential in understanding real-world risk. Especially in markets with thin files or first-time borrowers.

In lending, behavioral data means the digital and financial habits of applicants. These are shown through online activity, device use, and transactions.

These patterns help lenders look past basic checks to judge a borrower’s intent, consistency, and reliability.

Let’s look at three key categories that play a role.

#1. Transaction behavior, or how borrowers spend and earn

Spending behavior is a window into a person’s priorities and financial habits.

Lenders can see how borrowers manage their money by reviewing bank transactions, digital wallet use, or open banking data.

Are they spending mostly on rent, groceries, and transportation? Or is there heavy discretionary spending on luxury goods or gambling apps?

Recurring payments are another powerful signal. Regular payments for utilities, phone plans, and streaming subscriptions suggest a disciplined approach.

These aren’t flashy metrics. But they reveal a borrower’s ability to stay on top of recurring responsibilities.

Income deposits round out the picture. A steady stream of income, even if from freelance or gig work, indicates financial predictability.

Paired with consistent cash flow, it builds trust in the borrower’s ability to manage repayment.

More advanced platforms apply Transaction Risk Analysis (TRA) on top of this data. This involves:

- Anomaly detection to flag irregular patterns (e.g., sudden spikes in spending or multiple failed payments).

- Predictive insights that anticipate financial stress based on subtle shifts in transaction behavior.

Used carefully, these patterns help lenders make decisions that are both faster and fairer.

#2. Device and usage behavior, or how borrowers apply

The device a borrower uses during onboarding can reveal more than just their tech preference.

Mobile logins from the same device and location over time suggest consistent usage patterns.

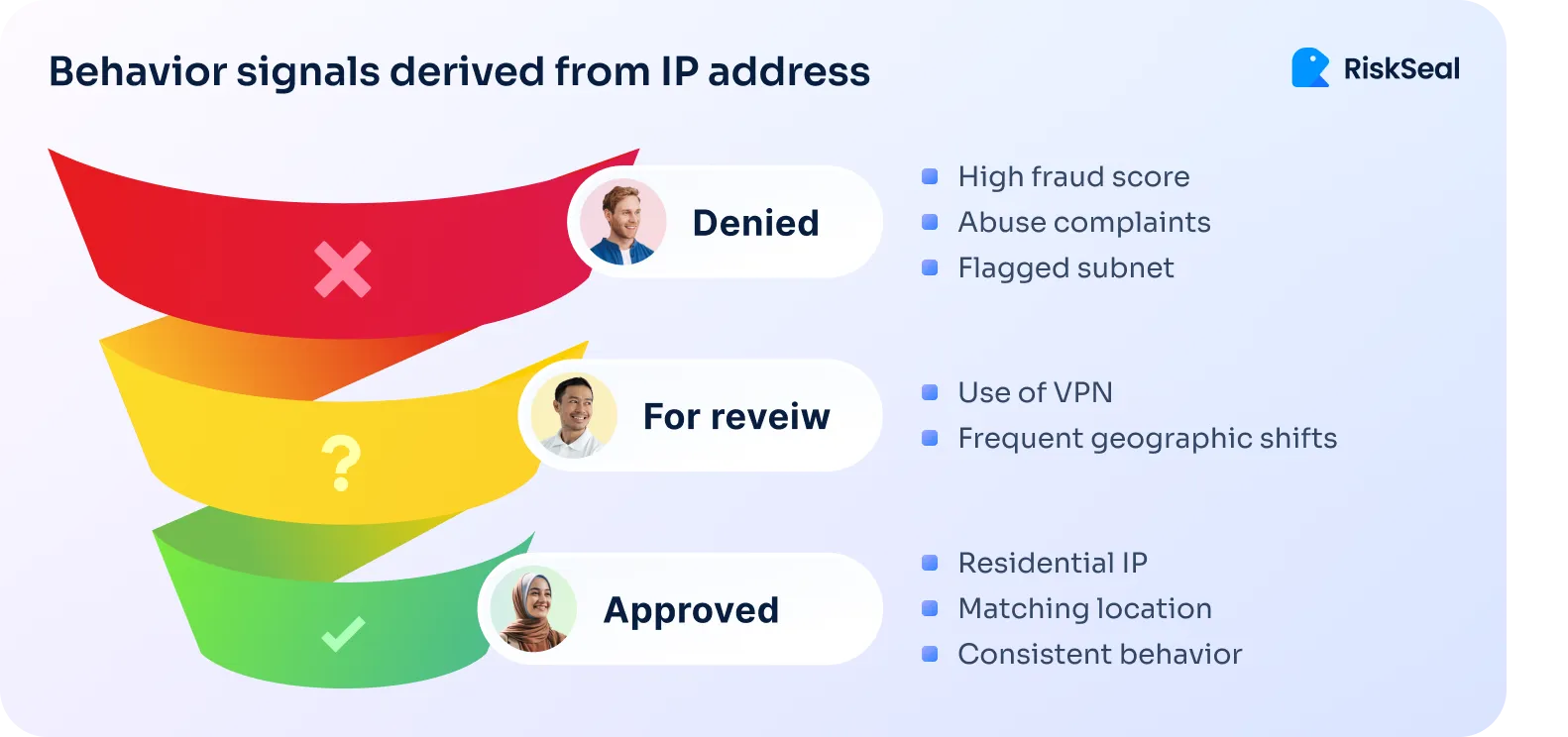

In contrast, applying under multiple identities or from suspicious IPs can flag suspicious or bot activity.

Behavioral fingerprinting also plays a role. It analyzes technical markers, like operating system, screen resolution, or browser configuration.

This helps detect inconsistencies and unusual patterns.

Lenders often look for:

- Device type. Smartphone vs. desktop, and whether it’s personal or shared.

- App usage. Frequency of logins, duration of sessions, timing (e.g., middle of the night).

- Geolocation signals. IP and GPS consistency with the declared address.

- Behavioral red flags. Autofill usage, speed of form completion, or simultaneous logins from different geographies.

These signals create a digital context for each applicant. It’s useful for both fraud prevention and trust-building.

#3. Communication behaviour insights, or how borrowers respond

How a borrower communicates before and after applying can also signal reliability.

It’s not about reading messages or personal content. It’s about observing patterns of engagement and responsiveness.

Applicants who reply to emails quickly or open notifications often are more engaged. Those who ignore outreach entirely tend to be less responsive.

Customer support behavior also highlights how borrowers handle pressure or resolve issues.

Here are some common behavioral markers lenders use:

- Responsiveness – reaction time to emails, texts, or in-app prompts.

- Engagement level – open rates, click-throughs, message acknowledgment.

- Support interactions – frequency of contact, tone of communication, issue resolution history.

- Sentiment signals – in AI-assisted setups, patterns in language can flag frustration, urgency, or evasion.

In context, these signals help tell apart genuinely delayed borrowers from those avoiding repayment. This distinction lets lenders respond with the right strategy.

Behavioral data use cases in credit risk decisions

Analyzing interactions and patterns allows lenders to spot both negative and positive signals.

Here are four common use cases.

Use case #1. Alternative credit scoring

For thin-file customers with limited credit history, traditional scoring may fall short. Transaction frequency and timely bill payments can act as reliable indicators of creditworthiness.

By using this data, lenders can expand credit access for underserved borrowers and tackle credit invisibility, showing in practice what is credit invisibility.

Use case #2. Early risk signals in financial behaviour

A drop in account log-ins or skipped repayment reminders can point to brewing financial stress. These changes may happen before a borrower misses a payment.

Lenders should act quickly to prevent defaults.

For example, by offering flexible repayment plans or early intervention.

Use case #3. Positive credit indicators

Not all behavioral patterns suggest risk. Some highlight a borrower’s commitment to repay.

Regular small payments or frequent checks of repayment schedules show proactive engagement.

Lenders can use this data to reward borrowers with better terms or faster loan approvals.

Use case #4. Consumer behaviour insights for fraud detection

Behavioral data can also help stop fraud before it causes losses.

A sudden shift in a borrower’s usual geolocation or device can trigger verification checks.

This quick response protects both the lender and the customer from unauthorized activity.

Ethical and compliance concerns in behavioural data science

Using behavioral data in credit decisions brings clear benefits. But it also raises important ethical and regulatory responsibilities.

Lenders must handle this information in a way that protects customers and meets legal requirements.

Data privacy

Behavioral data often includes sensitive details about customer activity.

Lenders must store and process this data securely, following laws such as the GDPR and other regional rules.

A compliant approach usually involves:

- Secure storage of behavioral data with encryption and access controls.

- Clear consent from customers before collecting any personal behavioral metrics.

- Defined retention limits to avoid storing data longer than necessary.

These measures help maintain compliance and protect customer trust.

Bias and fairness

If left unchecked, behavioral data can reflect or amplify existing biases. This could lead to unfair treatment of certain groups.

Lenders should test their models regularly to detect bias and apply corrective measures.

The goal is to make credit decisions based on relevant, accurate factors. Not stereotypes or indirect discrimination.

Transparency

Customers should understand how their behavior influences credit decisions. This means explaining, in plain language, which patterns are considered and why.

When people know what’s being measured, they can engage with the lending process more confidently.

RiskSeal’s approach

At RiskSeal, ethical data handling is built into every process.

The company follows strict compliance frameworks and holds ISO/IEC 27001 Certification. This demonstrates its commitment to high standards in information security.

All RiskSeal’s workflows align with global privacy laws, including GDPR and LFPDPPP. Disaster recovery protocols are SLA-ready, enabling real-time recovery with an RTO of 1 hour and an RPO of 15 minutes.

Overcoming implementation hurdles in behavioral data

In today’s lending, time-to-market is critical. Quick deployment of behavioral data directly influences customer acquisition and risk management.

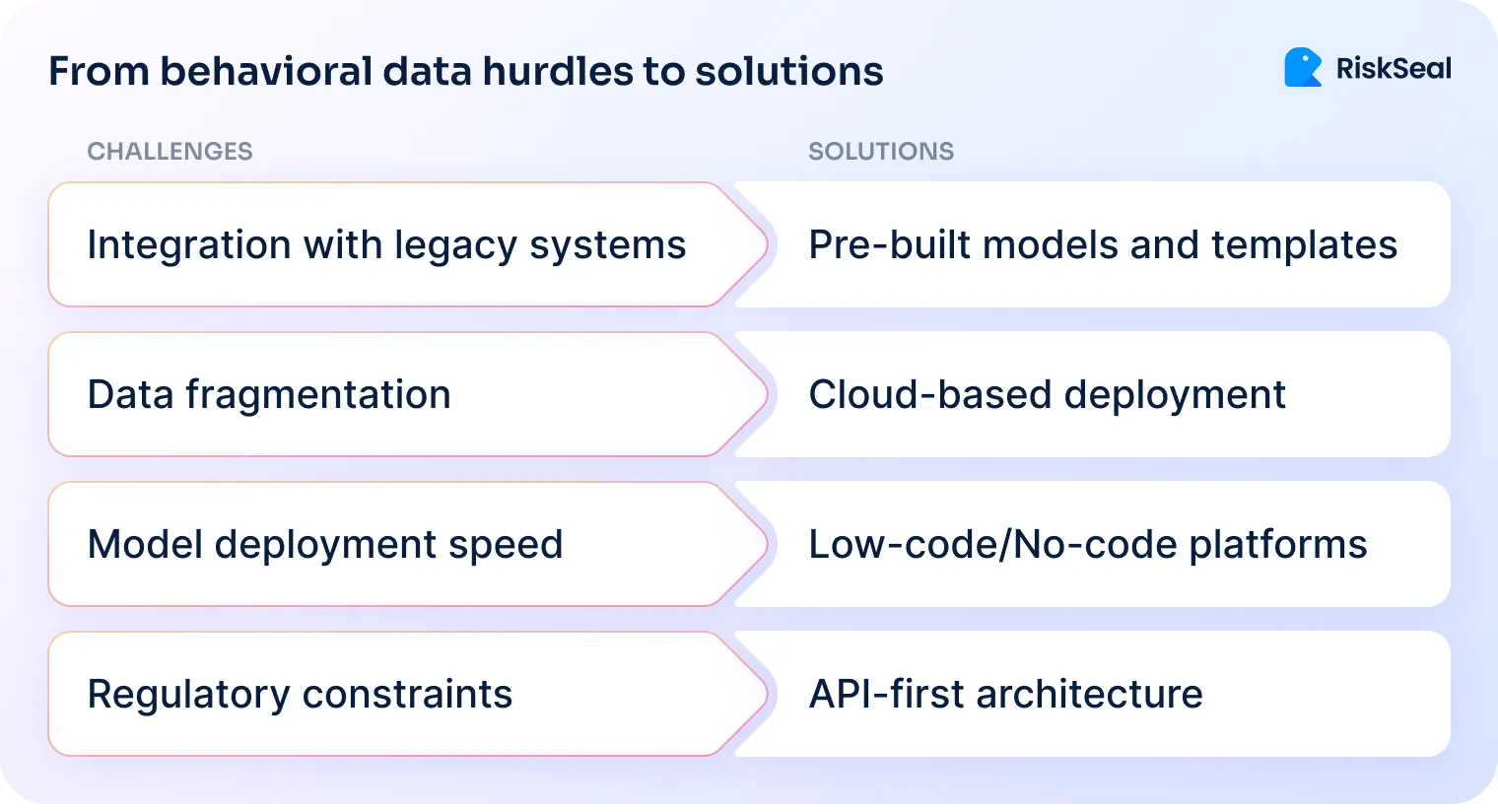

Implementation challenges

Integrating behavioral analytics into lending processes can be complex.

Common obstacles include:

Integration with legacy systems

Many lenders still rely on core banking platforms that were never designed for behavioral analytics. Bridging these systems requires custom connectors and extra testing.

Data fragmentation

Behavioral signals often come from multiple channels: mobile apps, websites, and third-party platforms. Without unification, these insights remain siloed.

Model deployment speed

Slow transitions from data ingestion to model testing can delay innovation in credit decisioning. This puts lenders at risk of falling behind faster-moving competitors.

Regulatory constraints

Meeting data protection, auditability, and explainability requirements adds extra layers of approval before launch.

Implementation methods for a behavioural scorecard in credit risk

There are several proven ways to incorporate behavioral data into credit scorecards:

API-first architecture

Plug-and-play APIs allow lenders to collect, process, and score behavioral data. All without long development cycles.

This is also the integration method used by RiskSeal. It enables lenders to embed behavioral analytics into their existing workflows with minimal disruption.

Pre-built models and templates

Some vendors offer ready-to-use behavioral scorecards. These accelerate proof-of-concept stages and shorten the path to full production deployment.

Cloud-based deployment

Hosting behavioral analytics in the cloud allows instant scalability, reduced infrastructure costs, and continuous model updates.

This is especially valuable for lenders operating across multiple markets or product lines.

Low-code/no-code platforms

With low-code or no-code tools, non-technical teams can set up rules and scoring parameters. A/B tests can also be run without heavy engineering support.

This democratizes behavioral analytics and speeds up experimentation.

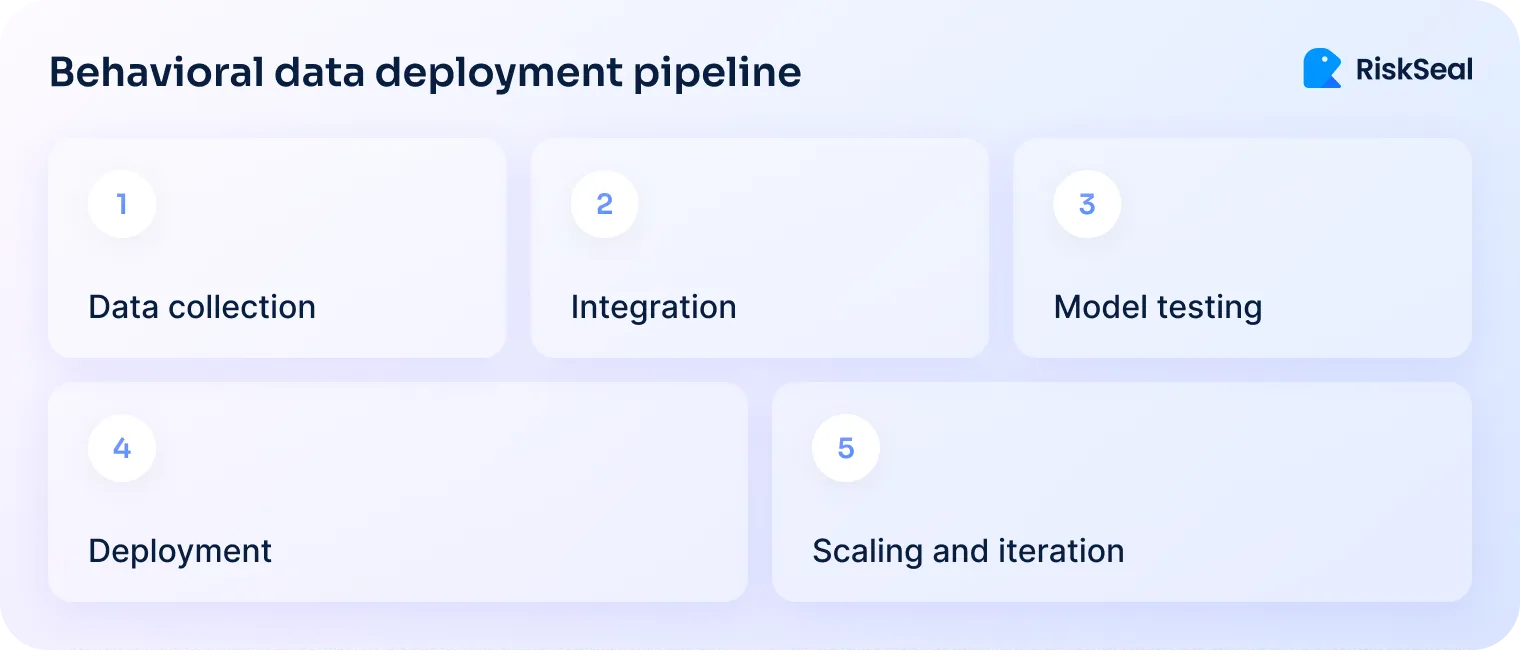

Best practices for implementing behavioral data

Adopting behavioral data analytics can improve loan performance and enhance customer experience.

The key is to follow a structured, test-and-learn approach that balances speed with compliance and trust.

1. Start with a targeted pilot program

Roll out behavioral analytics to a carefully chosen subset of loan products or customer segments.

This lets you measure results, refine models, and secure early buy-in without committing to a full deployment.

Key benefits of a pilot approach:

- Lower initial risk while testing new scoring models.

- Easier stakeholder approval through early, proven wins.

- Faster iteration cycles before company-wide rollout.

Many lenders begin with a proof-of-concept phase. It validates results and refines scoring strategies before scaling.

2. Build with modular, API-first architecture

Flexibility is critical for future-proofing your lending platform.

Modular systems allow you to swap or upgrade components independently. An API-first approach ensures smooth, low-friction integration.

3. Leverage sandbox environments for safe experimentation

A sandbox allows teams to trial new data models and decisioning logic without touching live systems. This reduces operational risk.

Why sandboxes accelerate progress:

- No risk to live operations during testing.

- Ability to compare multiple model versions side-by-side.

- Faster iteration on data-driven strategies.

4. Partner with experienced behavioral data providers

Specialized credit scoring software can bring ready-to-deploy infrastructure and deep compliance knowledge.

It helps shorten timelines and reduce complexity.

When choosing a partner, look for:

- Integration readiness through pre-built connectors.

- Regulatory alignment in model design and data handling.

- Proven scoring methodologies backed by behavioral science.

5. Monitor, measure, and recalibrate continuously

Borrower behavior changes over time, and your scoring models should too.

Continuous monitoring ensures accuracy and adaptability.

Ongoing optimization checklist:

- Track model performance metrics in real time.

- Adjust parameters when borrower trends shift.

- Schedule periodic model reviews and A/B tests.

The most effective lenders approach behavioral data adoption as an iterative process.

Starting small, scaling in stages, and making regular adjustments based on results.

Case study. A mid-sized lender boosted approvals with consumer behaviour data

A mid-sized online lender in Central Europe (the name is under an NDA) faced growing competition and tighter borrower assessment regulations. Thin-file applicants were especially hard to approve.

What went wrong?

Relying on traditional scoring, the lender approved only about 10% of applications from thin-file clients.

Manual verification was slow, taking up to three days. High default risk in new customer segments made the team cautious, limiting growth.

How the challenge was tackled

The lender implemented behavioral data analytics through RiskSeal’s solution in a 30-day pilot.

Behavioral signals were integrated via an API-first connection into existing workflows.

It automated risk scoring and replaced most manual checks.

The result

Approval rates in the thin-file segment rose from 10% to 19%.

Defaults fell by 18% in the first year. Decision time dropped from three days to three minutes.

Behavioral data allowed the lender to serve more customers, reduce risk, and stay competitive.

All without expanding its team.

Benefits of using behavioral data

Behavioral data gives lenders a deeper, more dynamic view of applicants.

It helps them make faster, fairer, and more profitable credit decisions. Especially when working with alternative credit data providers.

The key advantages include:

By turning everyday digital and financial behavior into actionable insights, lenders can improve both portfolio quality and customer relationships.

However, the effectiveness of behavioral data firmly depends on the alternative scoring provider of choice.

Credit behaviour analysis with RiskSeal

RiskSeal helps lenders turn behavioral data into clear, actionable risk signals.

By analyzing over 400 alternative data points, the platform identifies creditworthy borrowers early. It also detects potential risks and speeds up decision-making.

Key behavioral insights of our credit risk assessment software include:

- Spending patterns and subscriptions. Regular payments for services and stable purchasing behavior indicate financial discipline.

- Professional indicators. Employment status, career history, and education level help project earning stability.

- Device and location consistency. Detects anomalies such as unusual geolocations or multiple accounts on the same device.

Delivered via API, these insights greatly enrich scoring models.

RiskSeal’s data improves predictiveness (AUC 83%), cuts KYC costs by up to 70%, and reduces decision times to seconds.

The result: faster, fairer, and more precise credit approvals.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

FAQ

What are practical examples of behavioural data signals lenders can start using?

Lenders can track spending categories, such as essentials vs. luxury purchases. They can review payment consistency for bills and subscriptions.

Patterns in income deposits also reveal financial stability.

Digital footprint checks, like verifying if an email or phone is linked to trusted social profiles, can confirm applicant credibility.

How can lending institutions ensure ethical, compliant data usage?

Institutions should always obtain proper user consent. They must use data only for its stated purpose. Compliance with regulations like GDPR is essential.

Transparency matters, as it explains how decisions are made. Working with trusted vendors who follow industry standards reduces compliance risks.

How quickly can behavioural data solutions be deployed and scaled?

Modern platforms use API-first designs. This allows deployment in days or weeks.

Once live, they can handle higher volumes without major changes. Scaling to new regions or products is fast and efficient.

How does behavioural data enhance customer lifetime value and retention?

Behavioral insights help lenders offer relevant products and better repayment terms. This builds trust and drives repeat borrowing.

Lenders can also detect early signs of financial stress. Proactive support reduces defaults and keeps customers engaged.

Can behavioural data help launch or optimize BNPL and other innovative lending products?

Yes. It reveals short-term repayment capacity, even for thin-file customers. This enables safer BNPL offers.

It also helps refine eligibility rules and risk-based pricing. Better targeting improves adoption rates and repayment performance.

.svg)

.webp)

.webp)

.webp)