Key Credit Risk Issues for BNPL Companies

Discover how BNPL reshapes lending as split payments boost access and alternative credit scoring helps manage rising credit risk.

.webp)

Buy Now, Pay Later (BNPL) is quickly changing how people use credit. It lets consumers split purchases into instant, interest-free installments.

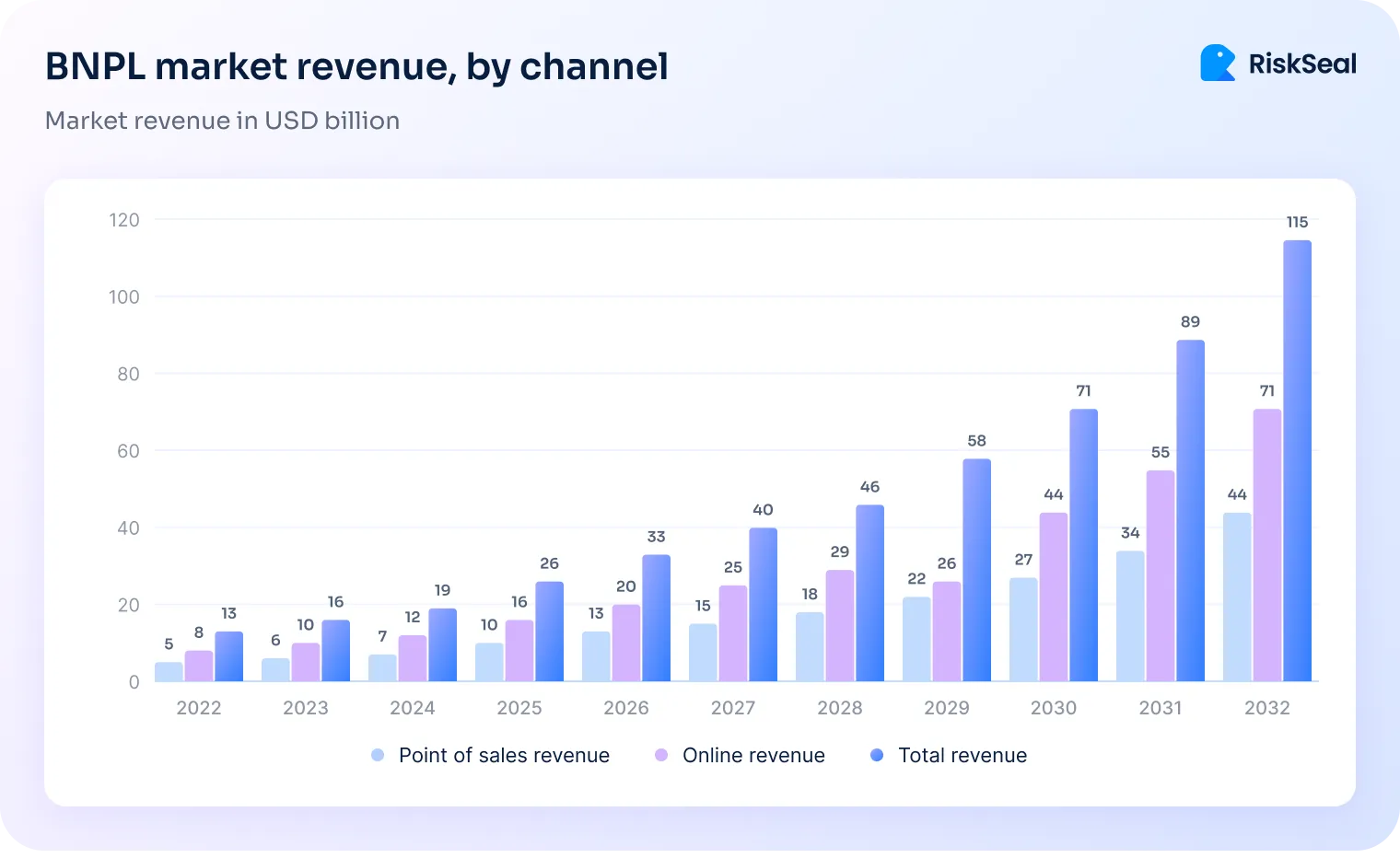

According to Investopedia, the global BNPL market reached over $179 billion in 2023 and is projected to grow to $3.7 trillion by 2030.

This rapid growth creates new challenges for assessing credit risk, especially since many users don’t have traditional credit histories. That’s where alternative credit scoring for BNPL providers becomes important.

Top 5 credit risk challenges in BNPL

According to Coin Law statistics for 2024, 1.4 billion adults remain unbanked. It’s an enormous growth market for BNPL, especially in developing regions.

Key risks to consider:

#1. Limited credit history

Many BNPL users are new to credit or have thin files. Since most BNPL loans aren’t reported to credit bureaus, lenders can’t see a customer’s full debt picture.

#2. Frequent, short-term loans

BNPL loans are small and repaid quickly, but users often take out several at once. This increases the never-pay risk.

#3. Loan stacking

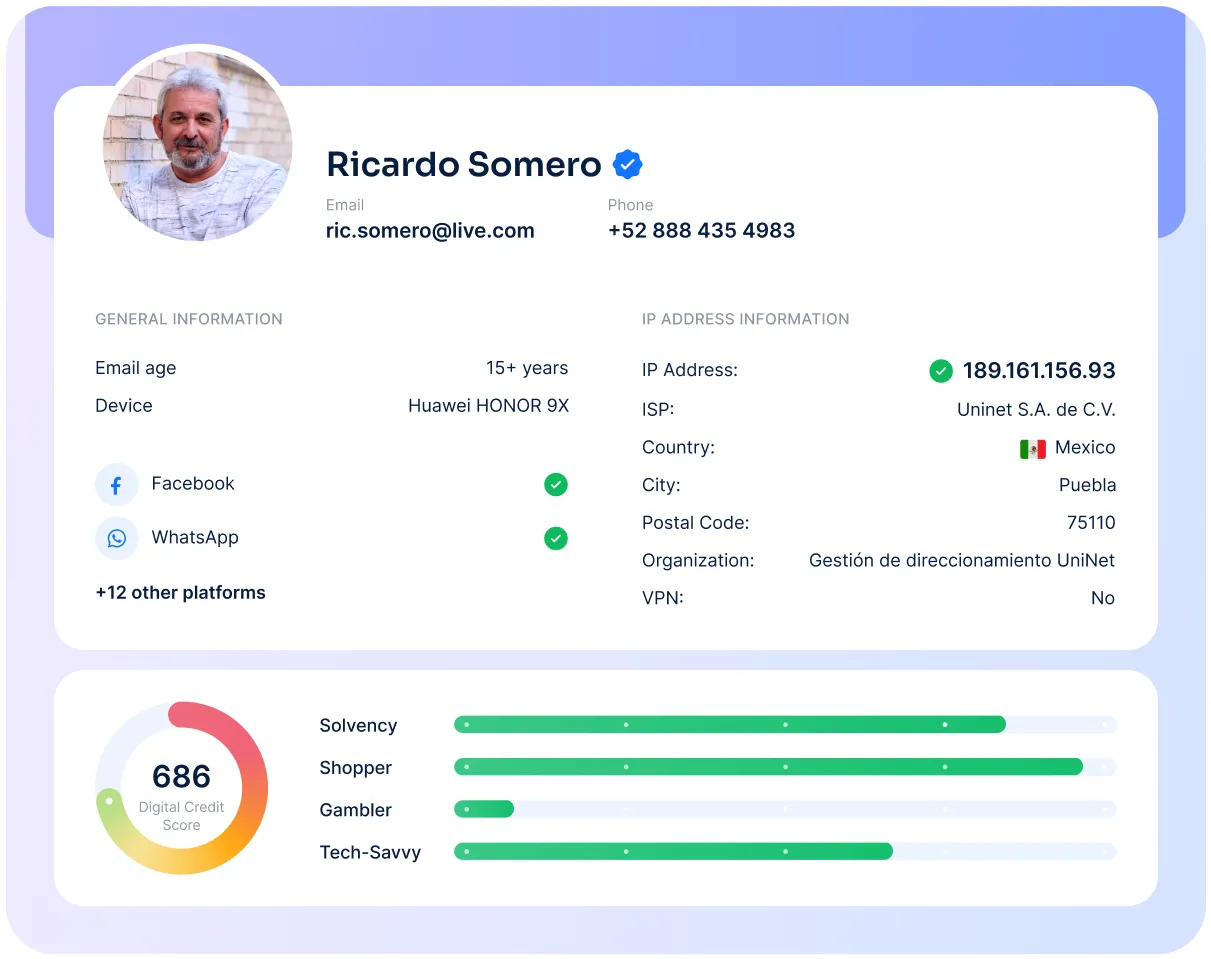

Without shared data between providers, users can stack loans across platforms. To reduce this “invisible” debt risk, BNPL companies increasingly rely on alternative credit scoring. It includes various checks from email age to a reverse phone number search engine to verify borrower reliability.

#4. Impulse spending

Fast, easy approvals encourage overspending. Many users misjudge what they can afford, leading to higher default rates.

#5. Economic sensitivity

BNPL users are often more vulnerable in tough times. During downturns, missed payments can spike due to short repayment cycles.

How BNPL uses alternative credit scoring

Alternative credit scoring is a way to assess someone's creditworthiness using non-traditional data.

Unlike traditional credit scoring, which looks mainly at credit history, repayment records, and defaults, alternative credit scoring for BNPL providers also includes data like:

- Digital footprints

- Spending behavior

- Social media activity

- Email data

- Mobile phone usage

- Location insights

This broader approach, often called digital credit scoring, helps BNPL providers evaluate people who may not have a formal credit history.

BNPL (Buy Now, Pay Later) providers can create detailed customer profiles by combining different sources of information.

This helps them check a customer’s creditworthiness and understand how reliable they might be financially.

10 strategic advantages for BNPL credit risk managers

1. Improved risk differentiation

Alternative data gives a clearer picture of each applicant, helping lenders spot reliable borrowers even in groups that usually seem risky. It helps tell apart people who are likely to repay from those who aren’t.

2. Lower default rates over time

Looking at how people spend and behave financially helps models better guess who will pay back loans. This means more good approvals, fewer missed payments, and stronger BNPL fraud prevention through early detection of high-risk users.

3. Staying ahead of regulations

As rules around BNPL get tighter, providers need to show clearly how credit risk decisions are made, especially when using AI. This helps them stay compliant and ahead of the curve.

4. Operational efficiency at scale

Using machine learning to run credit checks means fewer people are needed to do manual reviews, so companies can grow faster without hiring more staff or increasing costs.

5. Better customer retention & loyalty

By offering fair access to credit, especially for financially underserved consumers, BNPL providers can build trust and long-term loyalty, leading to increased lifetime value.

6. Instant credit decisions

Real-time decisions powered by AI and alternative data help lenders approve or reject applications instantly. These models quickly scan a wide range of data points to make smart, accurate calls.

7. Geographic & demographic expansion

Alternative credit scoring makes it easier to assess risk in emerging markets or younger populations, where traditional credit bureaus have limited coverage.

8. Competitive differentiation

Faster, smarter, and more inclusive credit decision-making becomes a brand differentiator, particularly in a crowded BNPL market.

9. Faster product iteration

Better data about how users act and repay loans makes it easier to quickly test new loan offers, repayment plans, or special deals.

10. Revenue growth from underserved segments

Reaching creditworthy people who are often ignored helps BNPL providers grow their income in new and steady ways.

Final words

BNPL is reshaping credit. But with big growth comes big risks.

By embracing alternative credit scoring and advanced BNPL risk management practices, providers can turn those risks into smart decisions, better service, and stronger growth.

The future of lending is faster, fairer, and fueled by better data.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

.svg)

.webp)

.webp)