Digital Signals for BNPL Risk Assessment

Explore the booming BNPL market and uncover how RiskSeal helps providers tackle rising fraud, defaults, and risk assessment challenges.

The use of Buy Now, Pay Later services, or BNPL, has become one of the lending trends among consumers.

Users like the idea of paying for a product later instead of at the time of purchase to reduce their immediate financial stress.

And that’s not the only advantage of BNPL. Among other benefits are:

- Minimal borrower requirements

- Zero interest on the loan

- Instant decision-making on applications

- Fast deal-closing process

For consumers, services like Klarna, Afterpay, or Affirm seem like the perfect solution.

But what about the providers themselves?

On the one hand, offering BNPL services allows BNPL to earn commissions from retailers and expand its customer base.

On the other hand, they face significant risks. The default rate for such deals remains extremely high.

Let’s talk about how to solve the problems of risk assessment for BNPL.

The rise and risks of BNPL

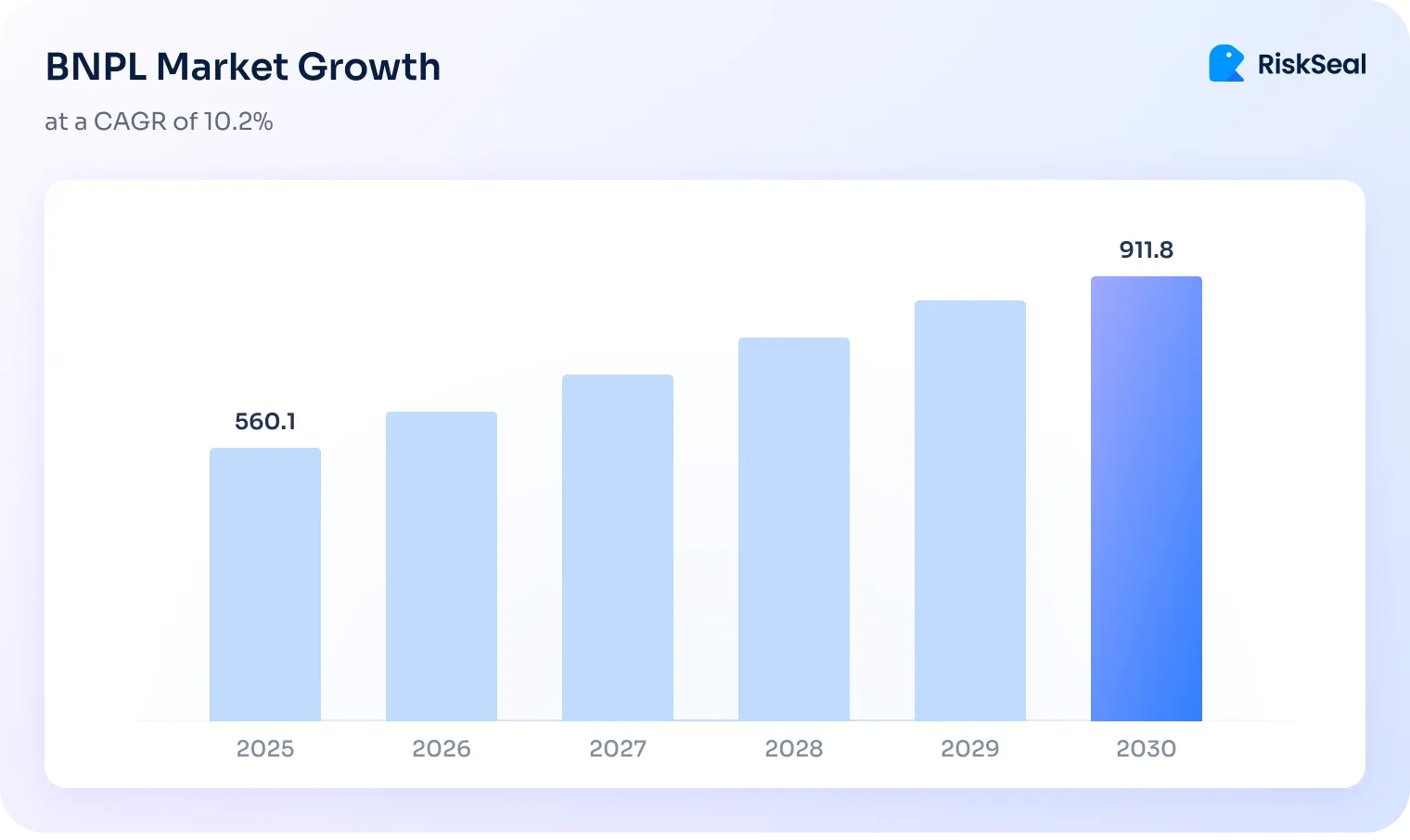

According to recent research, the global market volume for Buy Now, Pay Later services is measured in billions of dollars.

It is expected that by the end of 2025, the amount of BNPL payments will exceed $560 billion.

This is not the limit of the industry's growth. In the next five years, it is projected to show a CAGR of 10.2% and reach $911 billion by 2030.

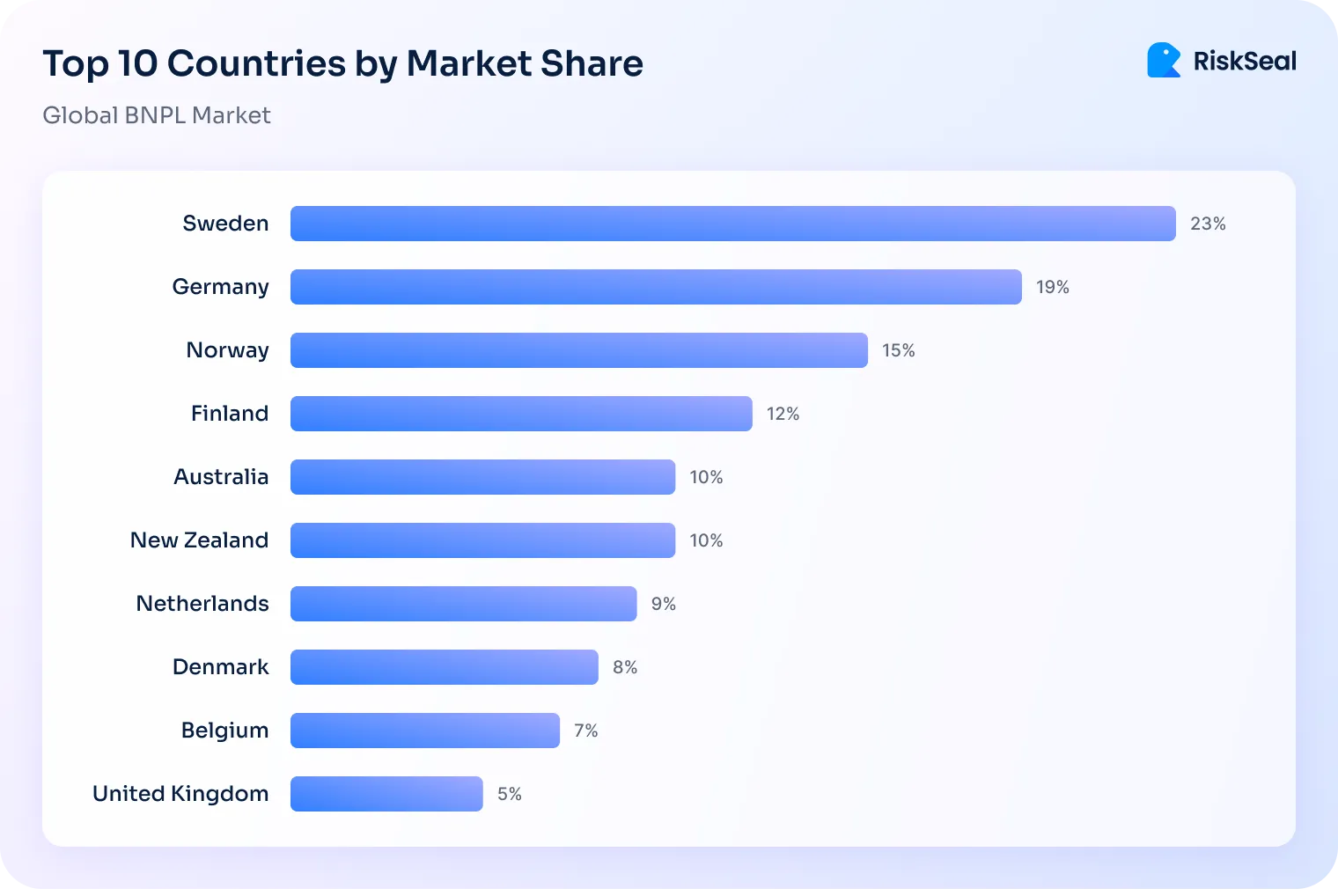

As for the geography of BNPL service adoption, the current leaders in terms of implementation are Sweden, Germany, and Norway:

Experts are confident that shortly, their popularity will grow in developing markets as well.

For example, in Africa and Southeast Asia, BNPL platforms serve as tools to improve financial inclusivity.

Such rapid industry development brings about a significant problem.

Along with the growth in the popularity of BNPL platforms, the level of financial losses for lenders also increases. The cause of these losses is overdue payments on transactions and an increase in the number of fraudulent applications.

Research by the Australian company RFI Global shows that 15% of borrowers default on Buy Now, Pay Later transactions. For consumers with low credit scores, this figure rises to 22%.

Fraud is another problem faced by lenders.

Experts say fraudsters often target these platforms because their credit checks are less stringent than those of major financial institutions.

BNPL fraud types RiskSeal can eliminate

There are many types of fraud associated with lending on BNPL platforms. That’s why BNPL fraud prevention solutions like RiskSeal play a critical role, eliminating high-risk applications before approval.

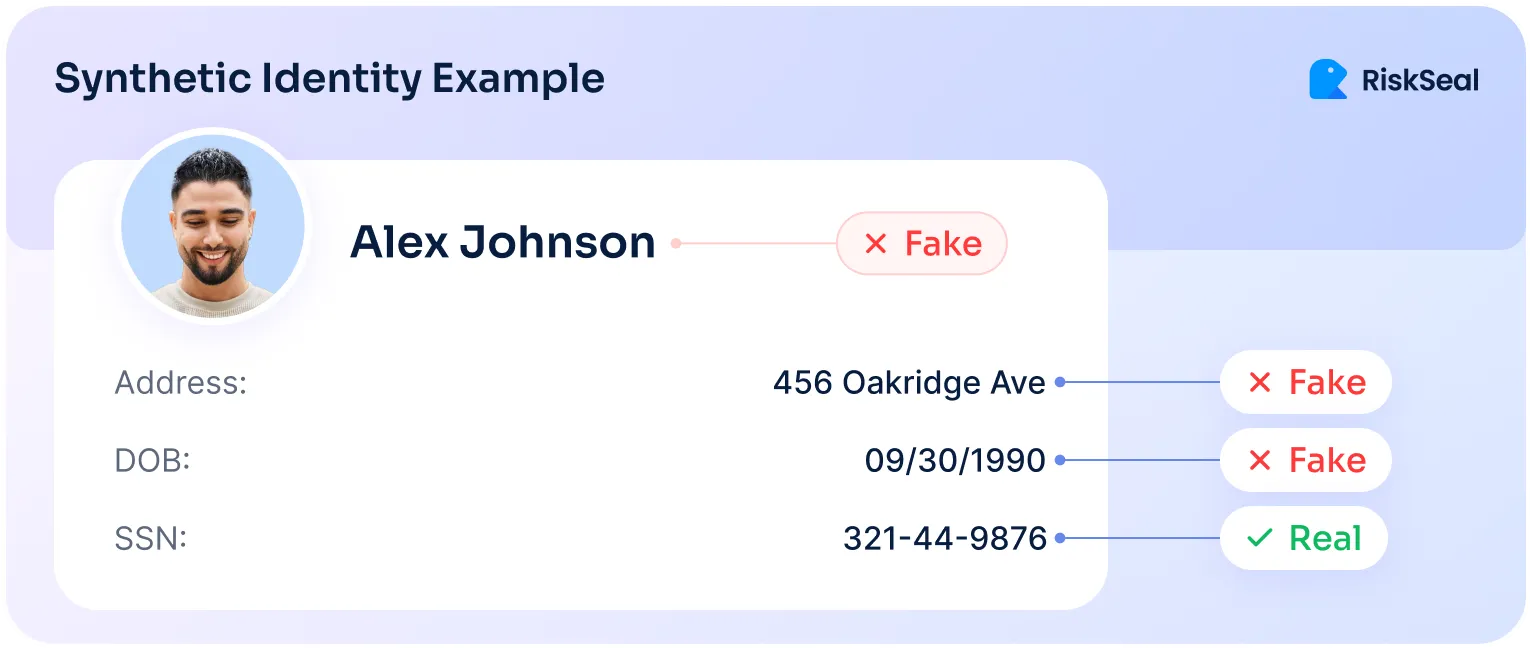

Synthetic identities

This type of fraud involves the creation of a fake identity using a combination of real and fabricated data.

Criminals may use a combination of names, birthdates, and social security numbers of different individuals and supplement this information with a fictitious address and a one-time phone number.

An application for a loan is submitted on behalf of this non-existent borrower. Naturally, with no intention of repaying it.

This is one of the most prevalent types of fraud. Experian data confirms this, with the company's report showing a 60% increase in such cases in 2024 compared to the previous year.

New account abuse

The essence of this scheme is as follows. Fraudsters open new fake accounts and use them to quickly complete transactions on BNPL services to never repay the debt.

The scale of the problem is confirmed by the fact that in 2024, nearly 29% of solutions in the fraud prevention market for BNPL were focused specifically on combating this type of crime.

First-party (intentional default) fraud

This type of fraud involves the intentional non-payment of a loan by the borrower.

A person applies for a product purchase through a Buy Now, Pay Later platform, already knowing that they will not repay the debt.

The main difference is that this fraudulent scheme is intentional, while an unintentional default usually happens because of financial problems or unexpected events.

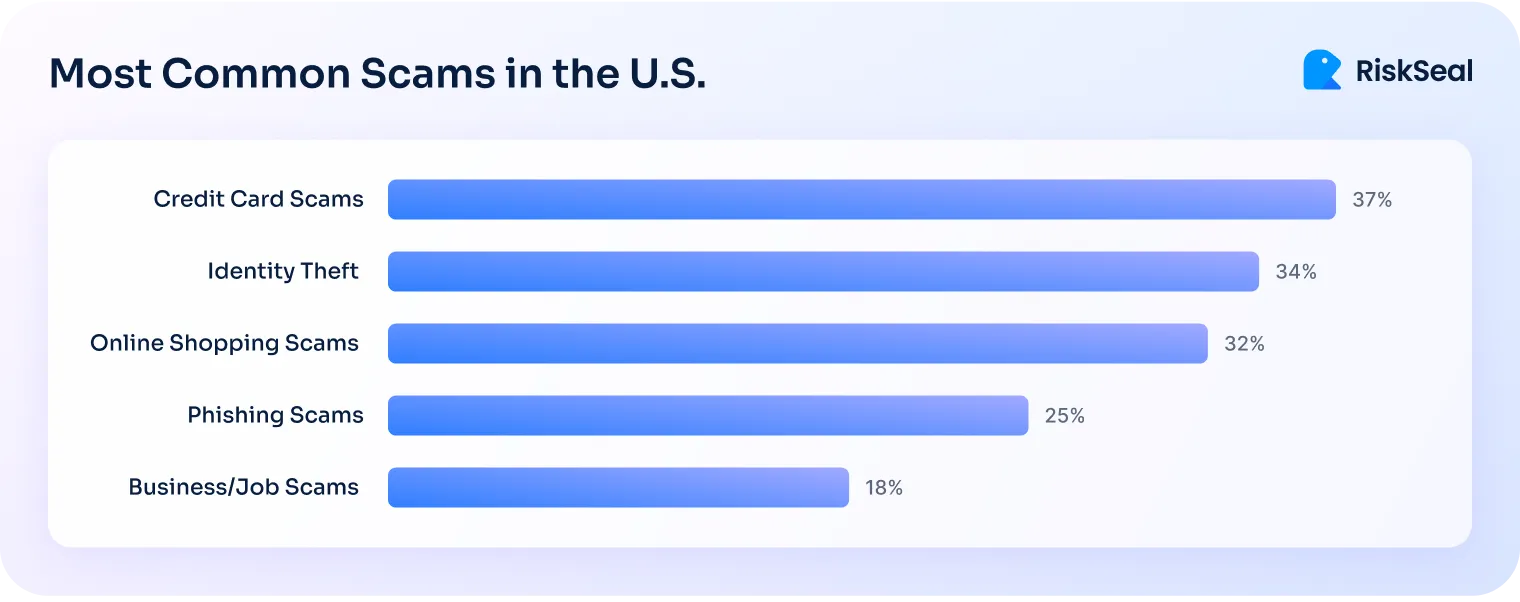

Identity theft

This type of fraud involves the theft of personal data for unauthorized use, such as completing Buy Now, Pay Later (BNPL) transactions without the rightful owner’s consent.

It remains one of the most common forms of financial crime.

In the United States, it ranks second in popularity among criminals, second only to credit card fraud. 34% of the country's population suffers from it:

Potentially, the data of each victim (about 115 million people in the United States) could be used to obtain fraudulent loans on BNPL platforms.

Promo abuse tied to identity duplication

BNPL service providers often resort to various promotional campaigns to attract new customers. For example, they offer interest-free periods or favorable loan conditions.

Fraudsters can take advantage of such offers multiple times by using fake or duplicate identities. As in other cases, they do not plan to repay the debt.

Money muling and layering

Money muling is when criminals use other people, called “money mules,” to move or transfer money gained from illegal activities.

In the context of Buy Now, Pay Later services, it might look like this: a fraudster purchases an item using such a platform, then convinces a “money mule” to accept the delivery of the item and resell it. Often in exchange for a portion of the revenue from the sale.

Layering further complicates tracking the fraudsters, as it involves transferring funds through multiple accounts or organizations.

9 types of digital signals used in BNPL risk assessment

A data enrichment solution for BNPL is one of the most effective tools for BNPL risk management, helping providers reduce losses and improve portfolio quality.

#1. Email and phone number metadata

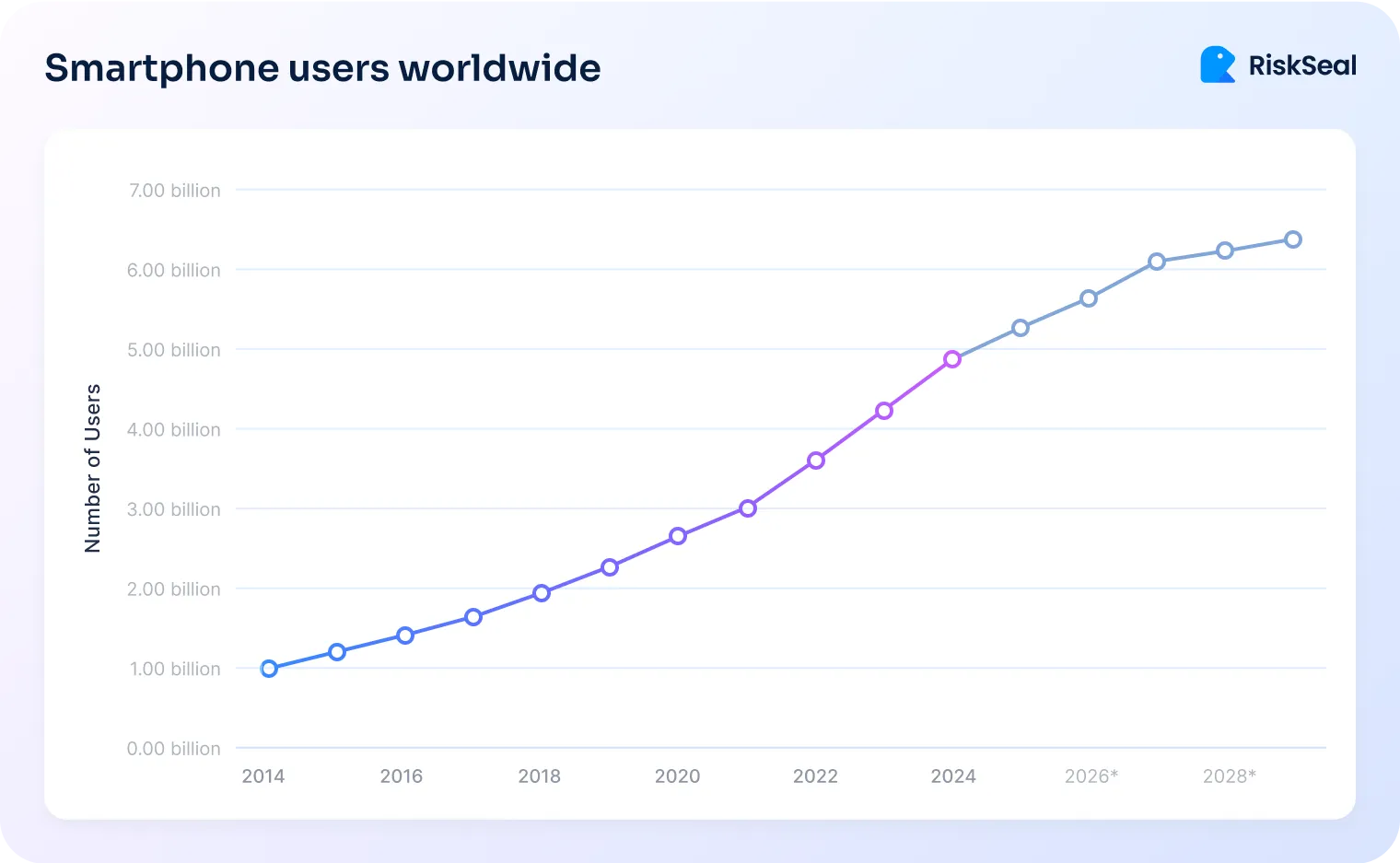

There are over 4.3 billion email users worldwide. The reach of mobile operators’ services is even broader. Currently, 60.4% of the global population owns a smartphone:

This indicates that by knowing the phone number and email address of the applicant, the lender can learn a lot of information about almost every potential borrower.

The list of available data includes:

- Reputation and age. How long the email or phone number has existed and how it's used across the web.

- Domain trust. Whether the email is from a disposable or suspicious domain.

- Phone carrier type. Shows if the number is prepaid, VOIP, or from a traditional carrier.

- Activity history. How active and consistent the digital identity has been across platforms.

- Fraud indicators. Use of known fraudulent contact data or mismatch with other provided identity signals.

#2. Platform registration data

Alternative credit scoring for BNPL allows you to learn everything about a user’s online activity, including their registration on various platforms:

- Social media footprint. Active and consistent profiles across Facebook, LinkedIn, Instagram, etc.

- E-commerce and financial apps. Presence on trusted platforms (e.g., Amazon, PayPal) as a signal of transaction history.

- Behavioral consistency. Consistent naming, location, and behavioral traits across multiple platforms.

For example, the scoring system RiskSeal analyzes over 200 online platforms, including global and local resources.

#3. Device & browser fingerprinting

Device details and how it’s used provide another valuable source of information. It provides the following digital signals:

- Device type and configuration. Detects if multiple accounts are being managed from the same device.

- IP and geolocation. Validates whether location aligns with claimed identity.

- Behavioral biometrics. Typing speed, mouse movement, and session patterns can flag bots or unusual access.

#4. Digital credit score & solvency indicators

Assessing borrowers using alternative data allows for a full financial profile of the applicant.

By using a reliable scoring system, you gain access to:

- Proprietary scoring. A synthesized score (e.g., at RiskSeal, derived from 400+ digital attributes).

- Payment potential indicators. Based on platform usage, online behavior, and inferred income or stability signals.

#5. Name verification & ID cross-check

In advanced credit decisioning for BNPL, scoring systems use digital signals to help verify if the borrower’s identity is genuine.

This is made possible through the following checks:

- ID consistency. Validates name consistency across platforms to detect stolen or synthetic identities.

- Face recognition (if available). Matches name to visual identity in certain use cases.

#6. Real-time risk flags

One problem with traditional credit scoring is that it relies on historical data, which can be outdated when the customer applies for credit.

Modern scoring systems solve this problem by identifying suspicious facts in real-time, namely:

- Velocity checks. Too many applications in a short time may signal fraud.

- Anomalous patterns. Inconsistent data inputs or use of proxies/VPNs.

#7. User behavior & engagement signals

AI credit scoring uses specialized algorithms capable of detecting patterns in user behavior and identifying unusual suspicious trends.

This includes the ability for the lender to track:

- Engagement levels. Frequency and pattern of platform logins.

- Trust signals. Reviews, network size, job history (from LinkedIn), or other engagement metrics.

- Time of access. Unusual time-of-day usage may flag bots or fraud attempts.

#8. Fraud & scam detection

Early detection of fraud is one of the main advantages of credit risk assessment using digital footprints.

Lenders gain access to signals such as:

- Fake or synthetic identity detection. Cross-referencing the digital footprint with known scam markers.

- Flagged devices or numbers. Previously used in fraudulent applications.

#9. KYC & identity verification support

According to statistics, KYC checks cost a company more than $2500. Modern scoring systems allow high-risk customers to be identified at the application stage, thus helping to save costs.

This is possible through the following digital signals:

- Low-friction onboarding signals. Verifiable digital identity to reduce the need for manual KYC.

- Confidence score. Combined indicators to justify instant approval or denial.

Role of digital signals in risk assessment

Digital signals can significantly optimize risk assessment for BNPL. Here's how this works:

1. Filling gaps left by traditional credit data. Traditional credit scoring does not allow for issuing loans to unbanked or underbanked individuals. These categories of people are considered credit-invisible by banks.

Digital signals make it possible to assess their solvency and issue credit even without a bank account.

2. Enabling real-time, automated decisioning. The use of digital signals makes it possible to automate BNPL decisions, ensuring faster approvals while minimizing fraud risks.

This approach allows for real-time adjustments to credit limits, improves user experience, and effectively combats fraud.

3. Detecting fraud and preventing “never-pays.” Analyzing the digital footprint of potential borrowers allows lenders to recognize major fraud schemes during the application review process.

This helps prevent “never-pays” before they happen and improves the quality of your credit portfolio.

4. Enabling inclusive and fair credit access. Digital signals allow BNPL platforms to serve non-traditional customers.

For example, freelancers who, due to a lack of official employment, are unable to obtain a loan from a traditional bank.

You can identify “invisible prime” customers who would otherwise be unfairly excluded.

5. Enhancing predictive power. A customer’s digital profile correlates with their creditworthiness and risk exposure.

In other words, enriching the scoring model with digital footprint analysis data enhances the accuracy of default predictions and optimizes credit performance.

6. Supporting cost efficiency. Alternative credit scoring allows BNPL providers to save not only on expensive manual KYC checks (up to 70% in the case of RiskSeal) but also to stay compliant with regulatory standards.

Conclusion

Buy Now, Pay Later platforms are growing fast - making shopping easier for customers.

With new opportunities come new risks: high never-pay rate is a tough challenge for providers.

This problem can be solved by combining traditional data with digital signals.

Want to know more?

Contact the experts at RiskSeal to help you build a strong risk assessment framework for your BNPL platform.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

FAQ

Who are the “never-pays” and how do they impact BNPL providers?

The term “never-pays” refers to Buy Now, Pay Later (BNPL) customers who sign up for payment plans but never make any payments.

These types of borrowers create risks for the lender, such as lower profits, damage to their reputation, higher debt collection costs, and more attention from regulators.

What types of BNPL fraud can be addressed with a Digital Credit Scoring system?

The main fraudulent schemes that can be addressed with digital scoring systems include synthetic identities, new account abuse, first-party fraud, identity theft, promo abuse tied to identity duplication, money muling, and layering.

What are digital signals, and how are they used in BNPL risk assessment?

Digital signals are data points that can be collected by analyzing the online activity of a consumer. For example, their registrations on various platforms, online purchases, etc.

BNPL platforms use these signals to create a comprehensive financial profile of an applicant, make quick decisions on loan applications, enhance financial inclusivity, and combat fraud.

How do digital signals fill the gaps left by traditional credit data?

Digital signals allow for the assessment of the solvency of unbanked and underbanked individuals, so-called credit invisibles. They provide BNPL businesses with additional data points that are not available through traditional credit scoring.

.svg)

.webp)