Subprime Loan

Discover what a subprime loan is and how lenders use alternative data to assess higher-risk borrowers more accurately while expanding fair access to credit.

Discover what a subprime loan is and how lenders use alternative data to assess higher-risk borrowers more accurately while expanding fair access to credit.

Subprime lending plays an essential role in financial inclusion. It gives more people access to loans when traditional channels would decline them.

However, this credit access comes with higher default risk. That’s why subprime loans often carry higher interest rates.

In this post, we’ll define what a subprime loan is and explain how it works in today’s lending landscape.

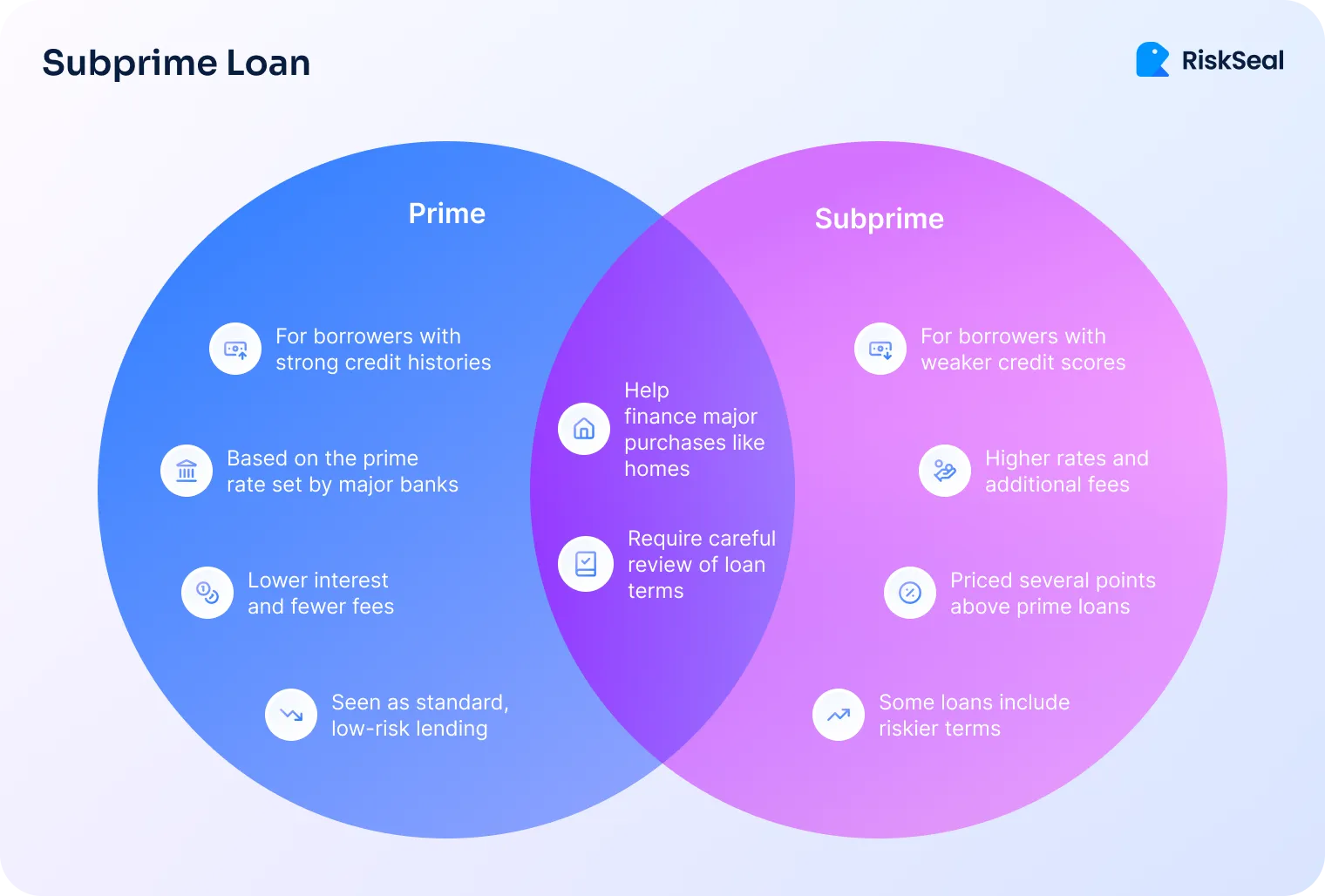

A subprime loan is financing offered to borrowers who don’t meet prime credit criteria. These are usually people with lower credit scores or limited repayment history.

Such loans compensate for the increased risk with higher interest rates, fees, or stricter repayment conditions.

Lenders usually look at several key factors to determine eligibility and pricing:

Despite the risk, subprime lending expands access for consumers who otherwise would be denied credit.

Lenders use credit scores, income verification, and debt analysis to evaluate subprime applicants.

They balance risk with pricing. Higher-risk borrowers are charged higher rates and may face shorter terms or collateral requirements.

Common structures include adjustable-rate loans, longer repayment periods, and prepayment penalties. These help lenders protect against default.

Subprime loans are common among lenders with near-instant approvals like BNPLs. That’s why managing repayment behavior is one of the top risks BNPL companies face.

When responsibly managed, subprime lending benefits both sides. Borrowers gain access to much-needed financing. Lenders tap new market segments and build diversified portfolios.

A subprime auto loan or subprime car loan is a vehicle loan issued to lower-scored borrowers. It enables them to purchase a car even when traditional lenders would reject the application.

Interest rates are typically higher to offset default risk. Loan terms may be longer or require a larger down payment.

These loans are common in both dealership financing and digital lending platforms.

A subprime mortgage loan allows borrowers with limited creditworthiness to buy a home. These loans have higher interest rates or adjustable-rate structures to balance credit risk.

After the 2008 US mortgage crisis, subprime mortgages became more regulated. Tighter affordability and verification standards were introduced to prevent predatory lending practices.

A subprime student loan helps individuals without strong credit or a co-signer fund their education. These loans also come with higher rates and less flexible repayment terms.

Modern lenders are improving student loan scoring by using additional data to assess default risk more accurately. These include academic performance or income potential.

Subprime lending has faced controversy due to its potential downsides.

High interest costs can create long-term debt pressure. And poor underwriting can expose both borrowers and lenders to losses.

Regulations now demand stricter regulations for creditworthiness assessment tools and clearer disclosures.

But responsible subprime lending requires more than compliance. It needs smarter data.

This is where alternative data jumps in. It helps lenders:

Data from employment stability, digital footprint, and transaction behavior offers a more current and nuanced view of creditworthiness.

It helps lenders lend confidently to underserved borrowers while keeping risk within manageable limits.

Subprime loans fill an important gap in the financial ecosystem. They expand credit access and give borrowers a second chance to prove repayment reliability.

Understanding what a subprime loan is helps lenders design transparent, data-driven products that promote inclusion.

With alternative data and the right credit scoring solution for online lenders, it’s possible without compromising portfolio health.