Social Media Footprint Analysis

Explore how social media footprint analysis helps lenders understand borrower intent and assess trustworthiness.

Explore how social media footprint analysis helps lenders understand borrower intent and assess trustworthiness.

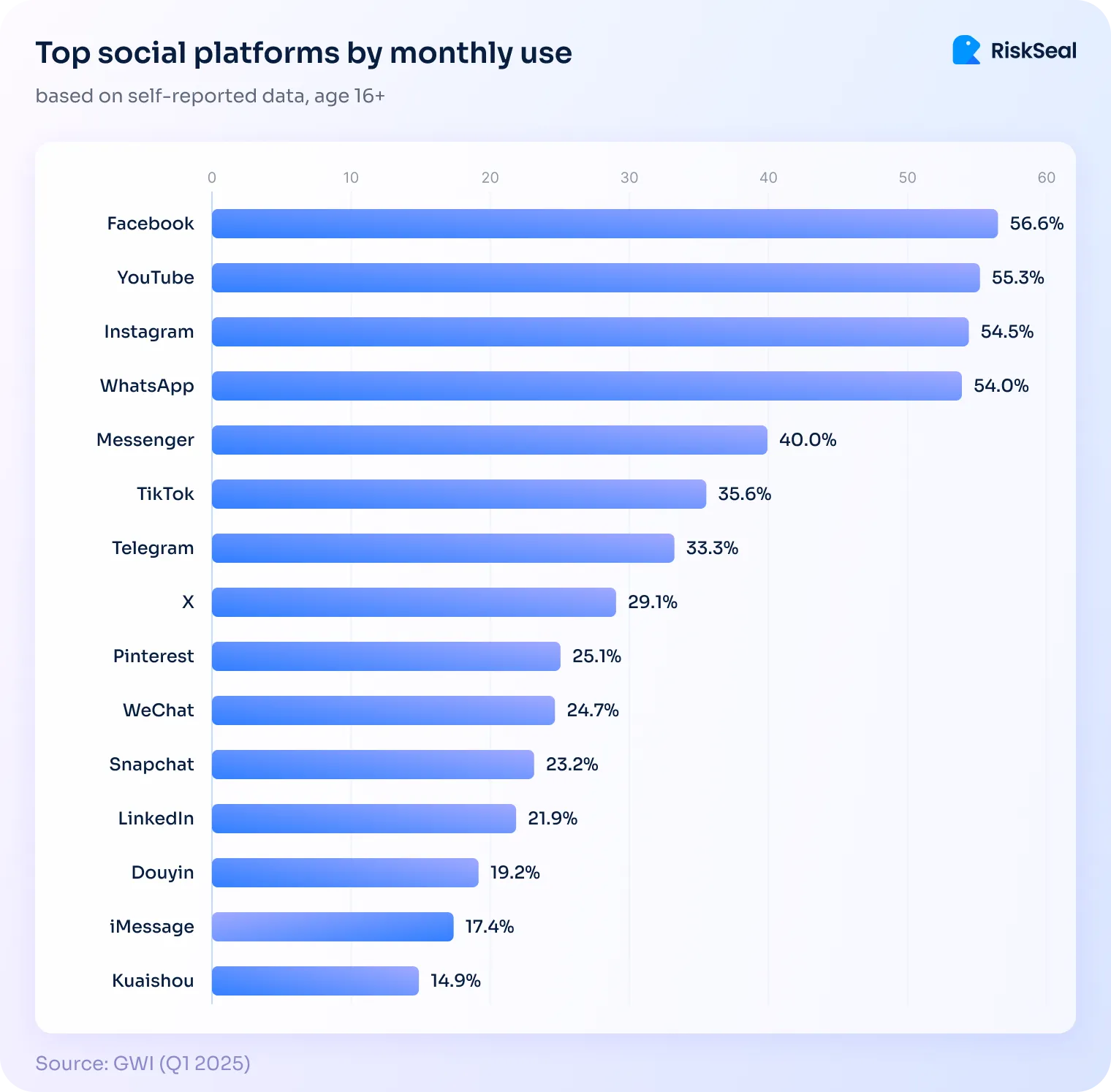

As of April 2025, over 5.3 billion people around the world use social media. That’s nearly 65% of the global population.

94% of internet users log into social platforms at least once a month. In just the past year, more than 241 million people joined. That’s a growth rate of 4.7% in just 12 months.

With so much activity happening online, social platforms now reflect key parts of people’s lives.

That’s why lenders can get many valuable insights from the social media footprint of borrowers.

Social media footprint analysis means looking at someone’s online presence to better understand who they are. It’s a way to collect signals that help lenders see the bigger picture.

A social media footprint includes things like your profiles, how active you are, who you’re connected to, and whether your info stays consistent across platforms. It also covers personal details shown on accounts, including:

Photos and profile pictures can also give clues. For example, whether an account looks real, active, and matches the person’s identity across networks.

In credit scoring, this kind of information is known as alternative data. It gives lenders extra context, especially when credit history is missing or limited.

The process of collecting and analyzing a user’s activity on social networks is called social media profiling. It helps build a detailed picture of the person behind the profile.

Traditional credit reports often miss important context, especially for people with little or no credit history. These include fresh graduates, gig workers, freelancers, and migrants.

Many of them are fully capable of repaying a loan. But they get denied because they don’t have past borrowing records.

Some avoid loans unless it’s something important. Others earn income from platforms or clients that don’t get reported to credit bureaus.

That’s where alternative credit scoring comes in. And social media footprint analysis is a big part of it.

It helps credit risk teams:

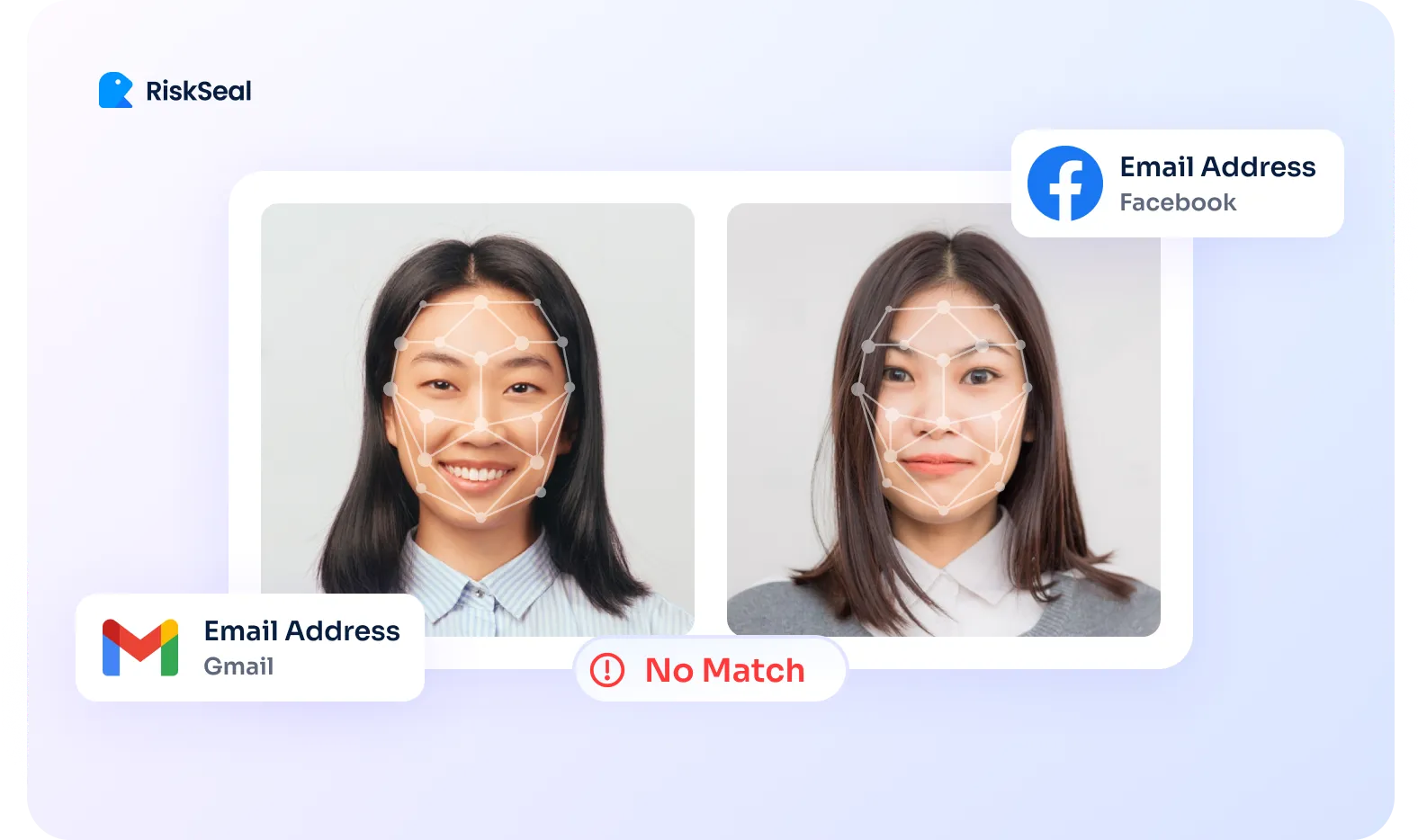

Modern digital scoring platforms use the applicant’s email address to check which social accounts are linked to it.

Meaning, it’ll see all social profiles where the declared email was used to sign up.

Here’s what’s social account search by email address usually reviews:

At RiskSeal, all of this happens with privacy and compliance in mind. No personal opinions or messages are read. It’s all about behavioral patterns, not personal content.

That’s how social media data gives credit teams an extra layer of insight, without crossing any privacy lines.

Social media data can offer helpful signals, but it’s not always reliable or easy to use. Here are a few common challenges:

That’s why social media profiling in credit scoring should only be used carefully and in context. Never as the only source of insight.

Social media footprint analysis helps fill in gaps. But it works best when combined with other signals.

That includes solvency assessment with digital footprints, device data, and behavioral patterns. Together, these tools give a clearer view of the applicant.

They help lenders say yes to more people, especially those missed by traditional systems. Used responsibly, social signals support smarter, safer lending.