Digital Credit Scoring Platform for Emerging Markets

API-based solution for real-time credit scoring powered by digital footprint analysis. Used by lenders across LATAM, Asia, Africa, and beyond to reduce risk, expand lending, and approve more reliable borrowers.

Key benefits of using alternative credit score software

Lend with confidence in emerging markets. Even when traditional data is limited.

AI-powered software

for credit scoring in real time

Our Digital Credit Scoring solution analyzes the borrower’s email, phone number, IP address, full name, location, and photo, then evaluates their digital footprint from over 200 online platforms.

With just a single API call, RiskSeal provides lenders with 400+ customer insights, a detailed client profile, and a ready-to-use digital credit score.

Why lenders choose RiskSeal

Approved customer base growth

Identification of trustworthy customers from high-risk ones, even with low or no credit rating.

Proactive default prevention

Stop defaulting loans before they happen and avoid the cost of debt collection, or loss from no repayment.

Credit risk reduction

Real-time, accurate, and extensive data to spot default risk, even in underbanked areas or without access to a credit bureau.

Market Expansion

Enter new markets by using a credit scoring tool to reach unbanked and underbanked populations.

Lower cost of risk

Leverage the predictive capability of AI and ML to improve digital scorecards, decreasing the cost of risk.

Great UX

Shorten the credit decision time from days to seconds with 400+ customer insights delivered in real time.

Industries we empower with real-time credit scoring

Online lending

RiskSeal helps online lenders go beyond traditional checks by using 400+ alternative data signals. Our credit risk rating software enables faster approvals, sharper risk assessment, and higher accuracy in spotting reliable borrowers.

BNPL

Our credit scoring software solution supports BNPL providers with real-time signals to assess creditworthiness and detect synthetic identities. This results in lower delinquency rates and stronger repayment.

Neobanks

RiskSeal’s digital credit scoring solution allows neobanks to evaluate applicants in seconds, flagging high-risk cases early and cutting onboarding costs. This way, more good customers can be approved without friction.

Banks

For traditional banks, RiskSeal enriches credit bureau reports with alternative data. By analyzing digital footprints, our credit scoring software reduces false approvals and increases portfolio resilience.

FAQ

What is RiskSeal's Digital Credit Scoring Platform?

RiskSeal is a real-time credit scoring platform that helps lenders understand risk by analyzing an applicant's digital footprint in real time.

When someone applies for a loan, RiskSeal looks at the digital activity linked to basic application details such as email address, phone number, and IP address.

It collects relevant signals connected to those identifiers and interprets them into a single, ready-to-use Digital Credit Score.

The score is built on digital and behavioral signals that have been tested across millions of applications and shown to be reliable indicators of repayment behavior.

As credit risk rating software, RiskSeal adds clear, science-backed context where traditional credit data is limited or outdated.

Here's a real-world example: a delivery driver with 2 years of steady income but no credit history would typically be auto-rejected by traditional systems.

RiskSeal analyzes their digital footprint – active WhatsApp account, Netflix subscription, stable IP address, years-old email – and reveals they're actually low-risk, enabling approval.

We also cross-match applicants’ profile photos and usernames to check if these look like belonging to one person, not some stitched together synthetic identity.

This helps lenders make faster, fairer, and more confident decisions, especially for thin-file applicants and informal workers who are invisible to traditional bureaus.

What data will I get by using RiskSeal's digital credit scoring solution?

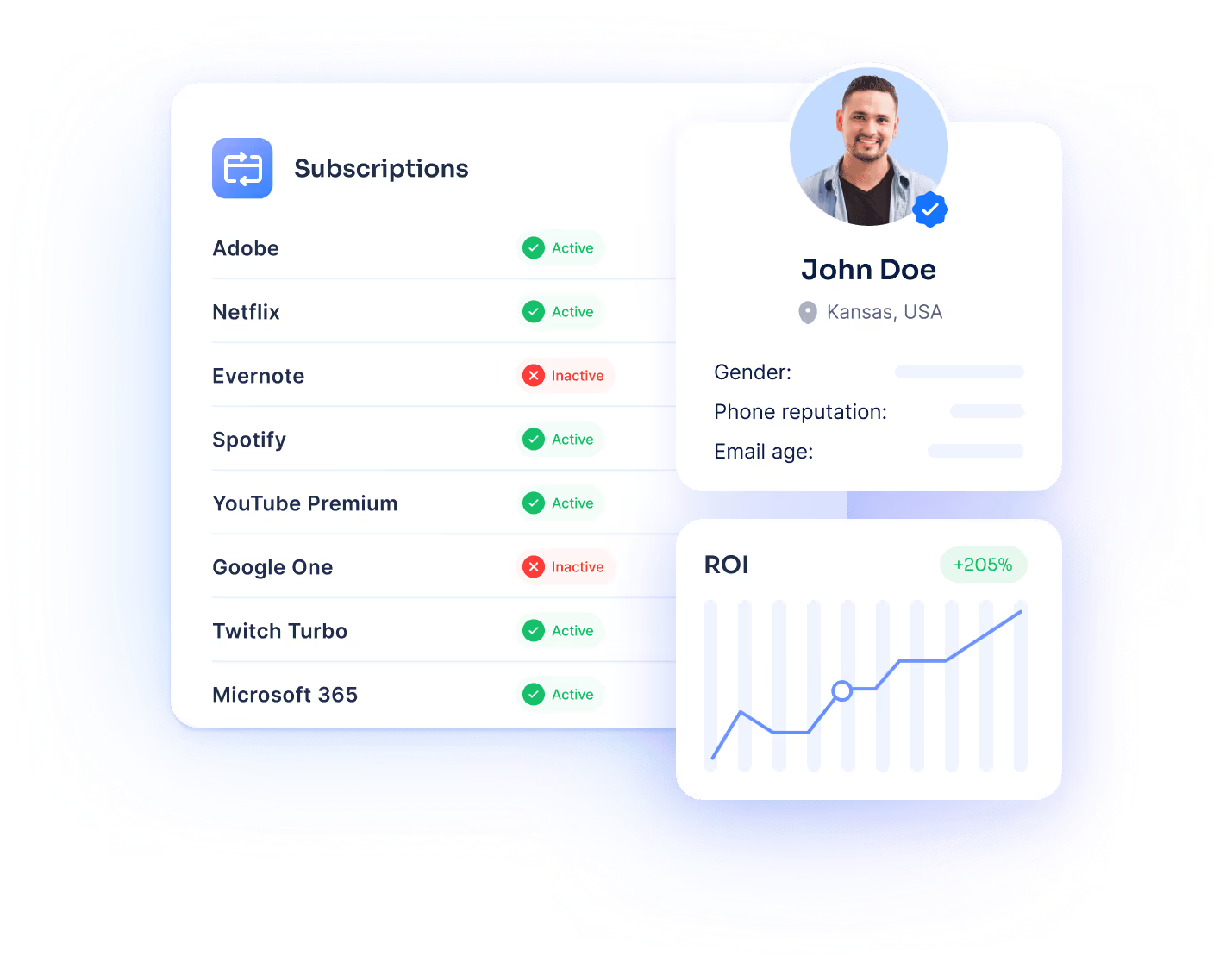

RiskSeal analyzes over 400 real-time digital signals that show how applicants behave and engage online. These signals help lenders understand identity strength, stability, and financial behavior.

You'll receive insights across 7 key data categories:

1. Email data. Checks if an email is valid, how old it is, what type of domain it uses, whether it was exposed in breaches, and where it is used online.

2. Phone number data. Confirms if a number is real and active, its age, carrier, blacklist status, and use on messaging apps like WhatsApp or Telegram.

3. Social media activity. Public signals from platforms like Facebook, LinkedIn, or Instagram that reflect digital maturity and consistency.

4. Online shopping behavior. Engagement with marketplaces such as Amazon, eBay, Walmart, Mercado Libre, and others. This shows account age and everyday purchase activity.

5. Paid subscriptions. Ongoing use of services like Netflix, Disney+, or Spotify. These patterns can indicate budgeting habits and financial discipline.

6. Web and tech services. Signals from accounts with Apple, Google, Zoho, and similar platforms that show long-term digital engagement.

7. IP and network data. Connection type and location checks that help detect unusual or high-risk access patterns.

RiskSeal also includes AI-based identity checks, such as name matching and face comparison across profile images.

This helps confirm that the same person appears consistently across platforms – a critical defense against synthetic identities and account takeovers.

Together, these signals form a complete picture of an applicant's digital life, revealing patterns that traditional credit bureaus simply cannot see.

How does RiskSeal's Digital Credit Score work?

The Digital Credit Score is a real-time, country-specific model built on behavioral patterns from over 100 million loan applications.

About the model:

Our digital scoring system evaluates both the quantity and quality of an applicant's digital presence – turning everyday online behavior into a predictive score from 0 to 999.

What it measures:

-Digital maturity. How long have they used their email, phone, and online accounts?

-Behavioral consistency. Do their devices, IP addresses, and identity elements remain stable over time?

-Financial signals. Do they maintain paid subscriptions, shop online regularly, and show signs of budgeting discipline?

Score ranges help guide decisions:

-0-299. Very high risk, frequent red flags, and mismatched signals.

-300-499. Elevated risk, requires enhanced verification or manual review.

-500-699. Moderate risk, acceptable with standard underwriting checks.

-700-799. Strong profile, solid applicant, minimal friction needed.

-800-899. Excellent profile, highly reliable digital footprint.

-900-999. Outstanding stability, exceptional trust, and consistency.

These ranges enable different operational workflows: enhanced verification for 0-499, standard processing for mid-range applicants, and automated fast-tracking for scores above 800.

The model doesn't just count how many platforms someone uses. It evaluates whether those platforms tell a coherent story – whether the person's digital life shows the kind of stability and consistency that predicts responsible repayment behavior.

How accurate is RiskSeal's Digital Credit Score compared to traditional credit bureau scores?

RiskSeal's research shows strong and stable predictive accuracy across millions of applications.

In independent testing conducted on over 6 million loan applications, our credit scoring software achieved an AUC of 0.67, meaning it reliably separates higher-risk borrowers from lower-risk ones, even without any bureau data.

When used together with traditional bureau scores, performance improves significantly:

-Digital-only model: AUC 0.67

-Bureau-only model: AUC 0.69

-Combined model: AUC 0.73

This uplift demonstrates that RiskSeal's credit score software adds valuable context that traditional data sources miss. Digital and behavioral data don't replace bureau scores; they strengthen them.

Why this matters: traditional bureaus struggle with thin-file and no-file applicants because they lack repayment history.

RiskSeal fills that gap by analyzing stability signals that exist even when formal credit records don't. The result is a more complete, accurate picture of an applicant's true creditworthiness.

In real-world deployments, lenders using RiskSeal alongside bureau data consistently see improved model discrimination, higher approval rates in underserved segments, and lower portfolio-level default rates.

Does RiskSeal support region-specific and local data sources?

Yes. RiskSeal's software credit scoring approach analyzes both globally popular platforms – such as Facebook, Instagram, Netflix, or Amazon – and region-specific services that people use in everyday life.

Local platforms are a crucial part of accurate credit risk assessment as they reflect how people actually live and operate in their country.

Someone who genuinely resides in Mexico will almost certainly use Mercado Libre or Didi Taxi. Someone in Poland will likely have an Allegro account. In Malaysia, Shopee is nearly universal.

Examples of local platforms RiskSeal supports include:

-Allegro in Poland

-Mercado Libre and Didi Taxi in Mexico

-Shopee in Malaysia

-Namshi in Saudi Arabia

-Rappi in Colombia

-Tokopedia in Indonesia

These local signals are especially valuable because they are hard to fake. People with genuine, long-term presence in a country almost always use certain local apps or services.

Fraudsters using fabricated or borrowed identities often miss these platforms or show inconsistent activity, simply because they don't know which services are essential in that market.

This creates a powerful fraud detection layer: real users pass naturally, while synthetic identities get flagged for showing internationally generic patterns that don't match local behavioral norms.

RiskSeal continuously expands its local data coverage to reflect real user behavior across regions.

This helps lenders make more accurate and fair decisions worldwide, whether they're operating in established markets or expanding into new geographies.

Can RiskSeal integrate with my existing loan processing system?

Yes. RiskSeal is designed as an API-based digital lending platform that works smoothly with your existing loan origination or decisioning infrastructure.

It integrates via RESTful API with minimal development effort and can be added as a risk enrichment module without changing your current workflow. You don't need to replace your existing credit scoring system—RiskSeal layers on top of it.

Implementation timeline:

-Initial API integration: 1 to 5 business days for technical connection and testing

-Full production deployment: 2 to 4 weeks, depending on internal testing, compliance approval, and workflow configuration

Our technical team supports you throughout the entire process to ensure integration is simple, fast, and aligned with your operational requirements.

We provide clear API documentation, sandbox environments for testing, and dedicated engineering support during rollout.

Whether you're using Salesforce, custom-built systems, or specialized lending platforms, RiskSeal fits into your stack as a flexible credit scoring tool that enhances your existing processes, not disrupts them.

Is RiskSeal digital credit solution compliant with privacy regulations?

Yes. RiskSeal is built on privacy-first principles and holds ISO 27001 certification for information security.

We are fully compliant with:

-GDPR (European Union)

-Mexico's LFPDPPP (Federal Law on Protection of Personal Data)

-CCPA (California Consumer Privacy Act)

-Regional data protection laws (across Latin America, Asia, Middle East, and Africa)

All data is collected with user consent, processed lawfully, and stored securely with encryption at rest and in transit.

We do not sell or share personal data with third parties outside the scope of credit assessment.

Our approach to compliance:

-Data minimization. We only collect signals necessary for credit risk assessment

-Transparency. Applicants understand what data is being analyzed

-Right to access. Users can request information about their data processing

-Secure infrastructure. Enterprise-grade security with regular audits and penetration testing

Privacy and compliance are not add-ons; they are core to how our credit scoring platform operates.

This ensures that as you expand into new markets or face evolving regulations, RiskSeal remains a trusted and compliant partner.

How fast is RiskSeal's real-time credit scoring?

RiskSeal delivers results in approximately 5 seconds per application.

This real-time speed enables:

-Instant approval decisions without manual queuing

-Reduced friction in the customer journey

-Immediate fraud detection before funds are disbursed

Processing time may vary slightly based on regional platform coverage and optional features like facial recognition or enhanced identity verification.

Why real-time matters: Because data is captured at the exact moment of application, you see who the applicant is right now, not weeks or months ago.

This helps catch evolving fraud patterns, respond to changing borrower circumstances, and approve legitimate customers faster.

Traditional credit bureaus pull historical snapshots. By the time you see that data, it may already be outdated.

Someone who lost their job two weeks ago still looks employed in bureau records. Someone building positive financial habits today still shows last year's thin file.

RiskSeal's credit scoring solution analyzes current behavior at the instant of application, giving you the most accurate, up-to-date risk signal possible.

This means fewer false declines, faster approvals for good borrowers, and better protection against fraud that tries to slip through outdated datasets.

The result: teams can approve confidently, catch risk earlier, and keep the customer experience smooth. All without sacrificing decision quality.

What outputs does RiskSeal provide?

RiskSeal delivers three primary outputs for every applicant, giving you flexibility in how you use our credit scoring software solutions:

1. Digital Credit Score (0-999). A single, country-specific risk score trained on insights from over 100 million loan applications.This score predicts repayment behavior at the exact moment of application and evaluates both the quality and depth of an applicant's digital activity. Higher scores indicate lower expected risk.

2. Raw signal data. Full access to 400+ individual data points via API – email age, phone carrier type, social profile links, subscription activity, IP geolocation, and more.This granular data allows you to build custom decision rules or enrich your existing models with new features.

3. Decision flags and risk indicators. Pre-configured alerts for high-risk patterns such as “TOR browser detected,” “email found in a spam list,” “invalid phone number,” or “identity mismatch across platforms.”

These flags enable immediate action without deep data analysis.

You can use the score as a standalone decisioning tool, layer it into your existing credit scoring system, or build entirely custom rules using the underlying signals.

This flexibility makes RiskSeal adaptable to different lending models: whether you're a microfinance lender focused on thin-file borrowers, a BNPL provider needing instant approvals, or a neobank building proprietary underwriting logic.

Our digital credit scoring platform scales to your needs.

What results can I expect during a Proof of Concept?

A Proof of Concept runs on your actual loan portfolio – typically 5,000 to 20,000 recent applications – to measure real-world performance before full deployment.

This isn't a demo with synthetic data. It's a rigorous backtest using your real applicants, real outcomes, and real business conditions.

Standard PoC structure:

-Data sharing. You provide 6-12 months of historical application data (anonymized if needed), including basic identifiers such as email, phone, IP, and loan outcomes.

-Independent scoring. RiskSeal credit scoring tool evaluates the dataset and returns risk scores and flags for each application.

-Client-side validation. You assess the overall impact of RiskSeal by comparing our scores with your historical approvals and outcomes.

Typical results clients observe:

-Model discrimination. +5 to 15 Gini points when RiskSeal signals are added to existing credit models

-Approval rates. 40-80% increase in thin-file segments, achieved without raising overall portfolio risk

-Default reduction. 15-25% improvement in portfolio-level default rates due to better segmentation

-Fraud detection. Earlier identification of synthetic identities, account takeovers, and coordinated fraud rings

Real example from our research. In a study of 6.1 million anonymized loan applications, we compared RiskSeal scores with actual default outcomes after 90+ days.

The results showed strong predictive power, with RiskSeal achieving 0.67 AUC on its own and 0.73 AUC when combined with bureau data.

Timeline. Most PoCs complete in 2-4 weeks, including secure data transfer, analysis, and results presentation with detailed recommendations.

The PoC validates whether RiskSeal’s signals add predictive power in your specific lending environment – across your borrowers, products, and risk appetite.

You see the exact lift in your own portfolio, not hypothetical benchmarks from other lenders.

How do I get started with RiskSeal?

Implementation follows three simple phases that take most clients from first call to production in 6-8 weeks total:

Phase 1. Proof of concept (2-4 weeks)

We score a sample of your recent applications to demonstrate measurable lift in approval rates, default reduction, and model accuracy.

This phase requires minimal effort on your side, just a secure data export of historical loan applications and outcomes.

You'll receive a detailed performance report showing exactly how RiskSeal would improve your decisioning compared to your current approach.

Phase 2. API integration (usually 1-5 business days)

Our engineering team helps connect RiskSeal's API-based digital lending platform to your loan origination system.

We provide RESTful API documentation, sandbox environments for testing, and hands-on support during technical integration.

Because RiskSeal is designed to layer into existing infrastructure, you don't need to rebuild workflows or replace systems. It simply adds a new data enrichment step to your current process.

Phase 3. Production rollout (2-4 weeks)

Phased deployment with ongoing monitoring, threshold optimization, and performance tracking.

We work with your risk team to ensure the credit scoring platform delivers the results validated during your PoC.

Throughout the process, you'll have dedicated support from our client success and engineering teams to ensure smooth implementation and fast time-to-value.

What you need to get started:

-Sample application data for PoC (5,000+ records recommended)

-API access to your loan origination system

-Alignment on decisioning workflows and approval policies

Once these basics are in place, RiskSeal becomes an operational credit scoring solution within weeks, not months.

How is RiskSeal different from traditional credit bureaus?

Traditional credit bureaus and RiskSeal serve different but complementary purposes in credit risk assessment.

Traditional bureaus:

-Rely on historical repayment data: loans, credit cards, utility bills.

-Struggle with thin-file and no-file applicants who lack formal credit history.

-Update slowly, often showing data that's weeks or months old.

-Miss behavioral signals from everyday digital life.

RiskSeal:

-Analyzes real-time behavioral and digital footprint data.

-Works especially well for thin-file, no-file, and informal workers.

-Captures signals in seconds, reflecting current applicant behavior.

-Reveals stability patterns that exist even without formal credit records.

The key difference: bureaus answer "How have they managed debt in the past?" RiskSeal answers "Do they show behavioral stability and consistency right now?"

An informal worker, freelancer, or recent immigrant might have no bureau history but a rich, stable digital life – years-old email, active subscriptions, consistent device usage, engagement with local platforms.

Traditional scoring systems reject them automatically. RiskSeal's credit scoring software solutions reveal their true creditworthiness.

Best practice: use both. Our research shows that combining RiskSeal with bureau data improves predictive accuracy from 0.67-0.69 (standalone models) to 0.73 (combined).

This is a significant lift that translates directly into better approval rates and lower defaults.

RiskSeal doesn't replace bureaus. It fills their gaps, making your overall credit scoring system more accurate, inclusive, and resilient to fraud.

What if an applicant doesn't use social media?

You don't need social media to receive a RiskSeal score. While social platforms are one signal category among many, they're not required for accurate credit assessment.

RiskSeal analyzes over 400 signals across 7 major categories: email, phone, IP/device data, e-commerce activity, paid subscriptions, web services, and social media.

An applicant can score well even if they use none of the social platforms.

Here's why:

Someone with no Facebook or Instagram presence can still show strong stability signals through:

-A 5-year-old Gmail account with consistent login patterns.

-An active mobile number tied to a major carrier for 3+ years.

-Regular use of Netflix, Spotify, or other subscription services.

-Shopping history on Amazon, eBay, or local eCommerce platforms.

-Stable IP addresses and devices over time.

These patterns demonstrate the same underlying trait that social media reveals: consistency, stability, and genuine digital engagement over time.

In fact, some of the strongest applicants in our dataset have minimal social media presence but deep engagement with financial and eCommerce platforms.

Such signals are often more predictive of repayment behavior than social activity.

The model adapts. RiskSeal's digital scoring system doesn't penalize applicants for missing any single signal type.

Instead, it evaluates the overall coherence and depth of whatever signals are present. The question isn't "Are they on Facebook?" but "Does their digital footprint tell a consistent, stable story?"

This approach ensures fairness across different demographics and user preferences, making RiskSeal's credit scoring solution effective whether someone is highly active online or maintains a more minimal digital presence.

Won't analyzing digital footprints violate privacy laws?

No. RiskSeal's credit scoring platform is designed from the ground up to comply with global privacy regulations, including GDPR and local data protection laws across Latin America, Asia, Europe, Middle East, and Africa.

Here's how we ensure compliance:

1. Consent-based data collection. Applicants provide explicit consent when they submit their information during the loan application process.

They understand that their digital footprint will be analyzed as part of credit risk assessment.

2. Public data only. RiskSeal analyzes publicly available signals and metadata, not private communications, messages, or protected content.

For example, we might see that someone has a LinkedIn profile and how old their account is, but we don't access private posts or messages.

3. Legitimate interest. Credit risk assessment is a recognized legitimate interest under GDPR and other privacy frameworks.

Analyzing digital signals to prevent fraud and assess repayment likelihood is legally protected when done transparently and proportionately.

5. Right to explanation. Applicants can request information about how their data was used in the decisioning process, and lenders using RiskSeal can provide clear explanations.

6. Secure processing. All data is encrypted in transit and at rest, processed in ISO 27001-certified infrastructure, and never sold or shared with third parties outside the lending relationship.

The bottom line: Digital credit scoring is legal, compliant, and increasingly standard practice in modern lending.

Major banks, fintechs, and microfinance institutions worldwide use these methods because they improve financial inclusion while respecting user privacy.

RiskSeal simply makes this process more accurate, transparent, and auditable, ensuring that privacy compliance and credit access go hand in hand.

How RiskSeal can improve the default ratio?

How does the integration with RiskSeal look like?

Can you provide examples of the digital and social footprint RiskSeal provides?

Does RiskSeal flag bad customers across the region?

.webp)