How to Advance Credit Scoring With Phone Number Lookup

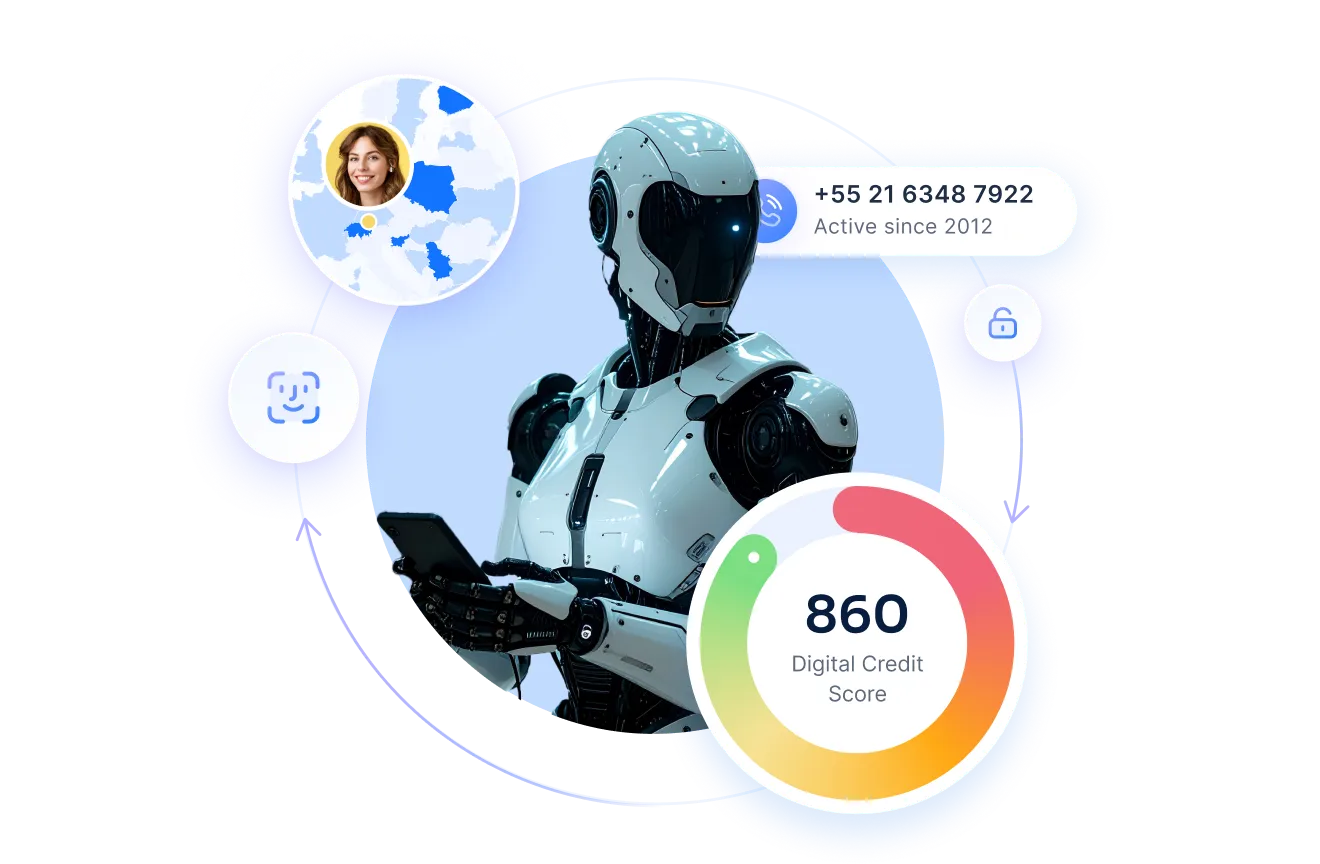

Discover how phone number lookup enables fintech providers to access valuable data about potential borrowers, including those without a credit history.

.webp)

Lookup by phone number is a useful tool, popular among fintech providers. Such a check allows you to find a lot of data about potential borrowers, even if they have no credit history.

This is a real opportunity to prevent fraud and complete the picture of a person’s creditworthiness.

Let’s talk about what phone number lookup is, what data you can find with it, and how lending business can benefit from using it.

What is a reverse phone lookup?

Reverse phone lookup is the process of searching for information about a person based on one data point – phone number.

Such a search is carried out in open sources such as instant messengers, social networks, and other online platforms.

The check gives the financial organization access to a wide range of data about the person and allows concluding their creditworthiness.

For example, if no account is associated with a phone number, it is a reason to suspect that the number is fake and assign a high-risk level to the borrower.

Cell phone usage statistics: phone number lookup perspectives

Mobile phones have long been an integral part of modern life, and data on their use is one of the foundations of digital footprint analysis.

Let’s highlight several facts that confirm the importance of using phone number lookups in modern credit institutions.

According to Statista, there will be 7.41 billion mobile phone users in the world by the end of 2024:

This means that information about the majority of the global population can be obtained by knowing their mobile phone numbers.

In addition, according to statistics, 96% of users of the World Wide Web use their mobile devices to access the Internet.

If we talk about the volume of mobile traffic by region, African countries are considered leaders in this area.

Here, 75.5% of all Internet connections are from mobile devices:

Fraud threat related to mobile operator services

Such widespread use of mobile operators’ services makes their subscribers a target for fraudsters.

For example, there has been an increase in cases of phone number theft – the so-called SIM Swap Scam, or simjacking.

Based on statistical data, there was a 400% surge in identity theft cases using this strategy in 2023 as compared to the previous year.

Stolen phone numbers are used by scammers to create synthetic identities – non-existent digital accounts that have a set of real and fictitious data.

An increase in cases of such fraud is noticed in recent years. In the United States alone, in 2023, the number of loans issued by criminals to synthetic personalities reached a record $2.9 billion:

How fintech providers can lookup a cell phone number?

Phone number lookup is possible because most users' phone numbers are connected with their online accounts.

Specialized tools search for such accounts, collect information about them, and provide the data found to the lender.

Such a search can be performed manually or using API calls – it depends on the capabilities of a particular tool.

The success of phone number lookup depends on how many public profiles associated with a particular phone number, as well as the functionality of the lookup tool used.

Information available through phone number lookup

Checking out a lookup phone number owner allows you to get a lot of data about a potential borrower.

Information about the phone number. For example, phone lookup allows you to identify incorrect and disposable numbers and virtual SIM cards.

Linked accounts on social media, online platforms, and messengers. The absence of linked accounts may indicate that the SIM card was purchased specifically to obtain a loan fraudulently.

Presence of the number in specific databases. For example, in spam lists or in databases of numbers with a high level of risk or blacklisted.

Mobile registration data. The lender can compare the mobile subscriber data with the information provided by the potential borrower in the loan application.

Correspondence between country code and IP address. Any discrepancies may indicate that the applicant provided incorrect information, which means such intentions are suspicious.

Meaning of phone number lookup for lending companies

Searching for information about a loan applicant by phone number can provide a lending institution with a range of advantages.

1. Increasing the efficiency of risk management. By checking the phone number, you can get a complete picture of the solvency of a potential borrower. It will reduce the number of fraudulently issued loans and reduce the default rate.

2. Accelerated decision-making. Phone number lookup allows checking in real-time. Thanks to this, you can assess borrowers instantly, speeding up the decision-making process and increasing the number of loans issued.

3. Productive fight against fraud. You will be notified of possible fraud immediately after the verification is completed. Phone lookup allows you to detect SIM card substitution, incorrect and disposable numbers, identity theft, virtual SIM cards, etc.

4. Cutting KYC expenses. This type of check, as part of digital credit scoring, allows you to identify up to 30% of unreliable borrowers at an early stage. This way, you will not have to spend money on the KYC checks for obviously unreliable clients.

5. Increasing approval rate. With phone number lookup, you'll have access to hundreds of alternative data points for potential borrowers. With their help, you will get a complete picture of creditworthiness and will be able to lend even to unbanked clients.

How RiskSeal can help with phone number lookup

Lookup by phone number is one of the checks carried out by the RiskSeal scoring system as part of the verification of potential borrowers.

In combination with other checks, including email address lookup, phone lookup allows you to get a complete picture of the borrower’s reliability and solvency.

Lookup by phone number allows our scoring system to provide clients with hundreds of alternative data points with only a potential borrower's phone number.

The check is implemented in RiskSeal in this way:

1. The lender provide us with the information specified in the loan application, including phone number.

2. We perform digital footprint analysis for accounts associated with this number – among other things, we carry out Facebook and Instagram lookups by phone number.

3. The next step is to check if the country code and IP address match.

4. We check the presence of the number in the databases of numbers with a high level of risk, recorded cases of fraud or spam.

5. Our solution identifies invalid, disposable numbers and virtual SIM cards.

6. After completing all of the above steps, we provide the lender with a wide range of alternative data about the potential borrower.

7. RiskSeal interprets the received data into a ready-to-use digital credit score with footprint insights.

The check is carried out in real time, and within a few seconds the client has all the information that is freely available on the Internet.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

FAQ

Why is phone lookup important for lending companies?

Phone number lookup plays a significant role for lenders, as it allows you to obtain information about the creditworthiness of potential borrowers, including those who do not have a credit history.

Due to the wide coverage of the global population by mobile operators, such verification makes it possible to assess the majority of residents even in countries where financial inclusion is low.

What are the benefits of using phone lookup for credit scoring?

Using phone lookup brings several benefits to lenders. These include increasing the efficiency of risk management, accelerating decision-making on loan applications, and, as a result, increasing the number of loans issued, reducing KYC costs, and expanding the client base. Also, such checks increase the productivity of the fight against fraud.

What types of data can be obtained through phone number lookup?

Lookup by phone number provides the lender with a wide range of alternative data. These include information about the mobile operator, the validity of the phone number, associated accounts, the presence of the number in specific databases, registration data of the cellular subscriber, and the correspondence between the country code and the IP address.

What is the role of phone number intelligence in preventing identity theft?

Phone number intelligence, among other things, allows detecting synthetic identifiers, simjacking, identity theft, and other fraudulent activities with a phone number.

In the context of lending, obtaining such information prevents the use of other people’s personal data for criminal purposes, namely, to get a loan that will obviously not be repaid.

.svg)

.webp)

.webp)