What Risk Scoring Is and Why It Is Critical for Modern Lenders

Learn how risk scoring enhances lending by assessing credit risk using traditional & alternative data.

.webp)

Without effective risk assessment, it is difficult to imagine the operations of modern lending organizations.

It helps assess potential risks when approving more applications and reducing defaults and fraud.

What is risk scoring? How does it work? How can it be made as effective as possible in today's realities? Read more about this and beyond in our article.

What is customer risk scoring?

Risk scoring in lending refers to the process of credit risk assessment by assigning a numerical score that reflects the likelihood of default or fraud by a potential borrower, helping lenders avoid issuing high risk loans.

Traditional scoring models use financial information from credit bureaus for this purpose. This includes the length of credit history, types of loans taken, payment timeliness, and other similar data.

However, in recent years, more and more lenders have pointed out the shortcomings of this practice.

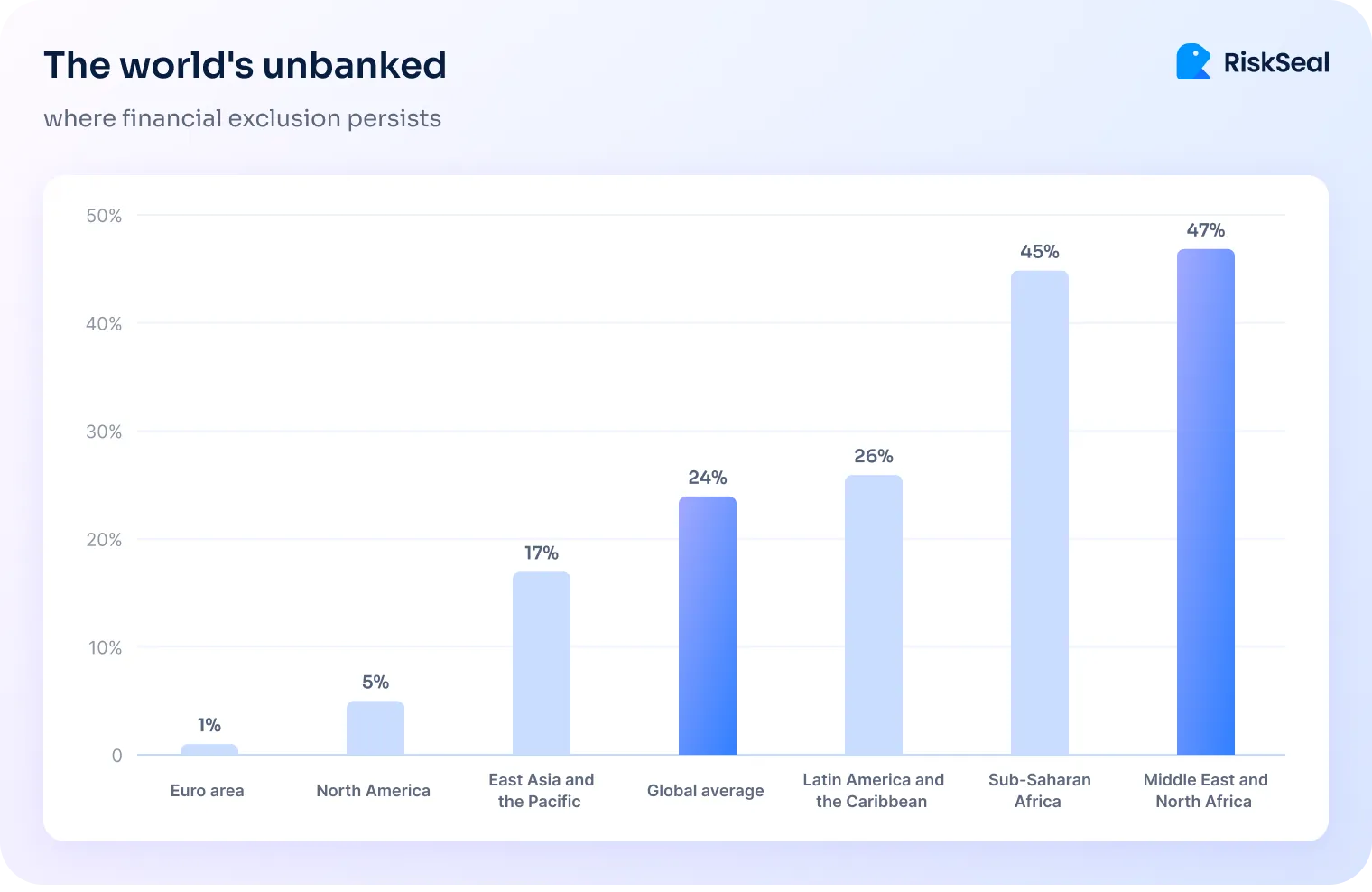

First, there are many consumers without a credit history — the so-called unbanked individuals. In some developing regions, they make up nearly half of the working-age population:

Secondly, traditional financial information is easy to falsify, which fraudsters successfully take advantage of.

According to a recent financial fraud report, 35% of banks and fintech companies encountered 1,000+ fraud attempts over the past year. Moreover, 1 in 10 respondents reported 10,000+ cases of criminal activity:

In this regard, the modern risk scoring methodology involves the use of alternative data. This refers to information about borrowers that is not related to their banking activity.

Such data may include details of any regular payments (utility bills or rent payments), information about mobile phone usage, and more.

However, the most informative source of such data is considered to be consumers’ digital footprints — all the information that remains publicly accessible on the internet as a result of users' online activity.

How risk scoring works: step-by-step process

The process of identifying high-risk borrowers in modern lending organizations occurs in several stages.

Stage #1. Data collection

This stage involves gathering hundreds of data points from alternative sources. These will later be used for a comprehensive digital footprint analysis.

Such data includes:

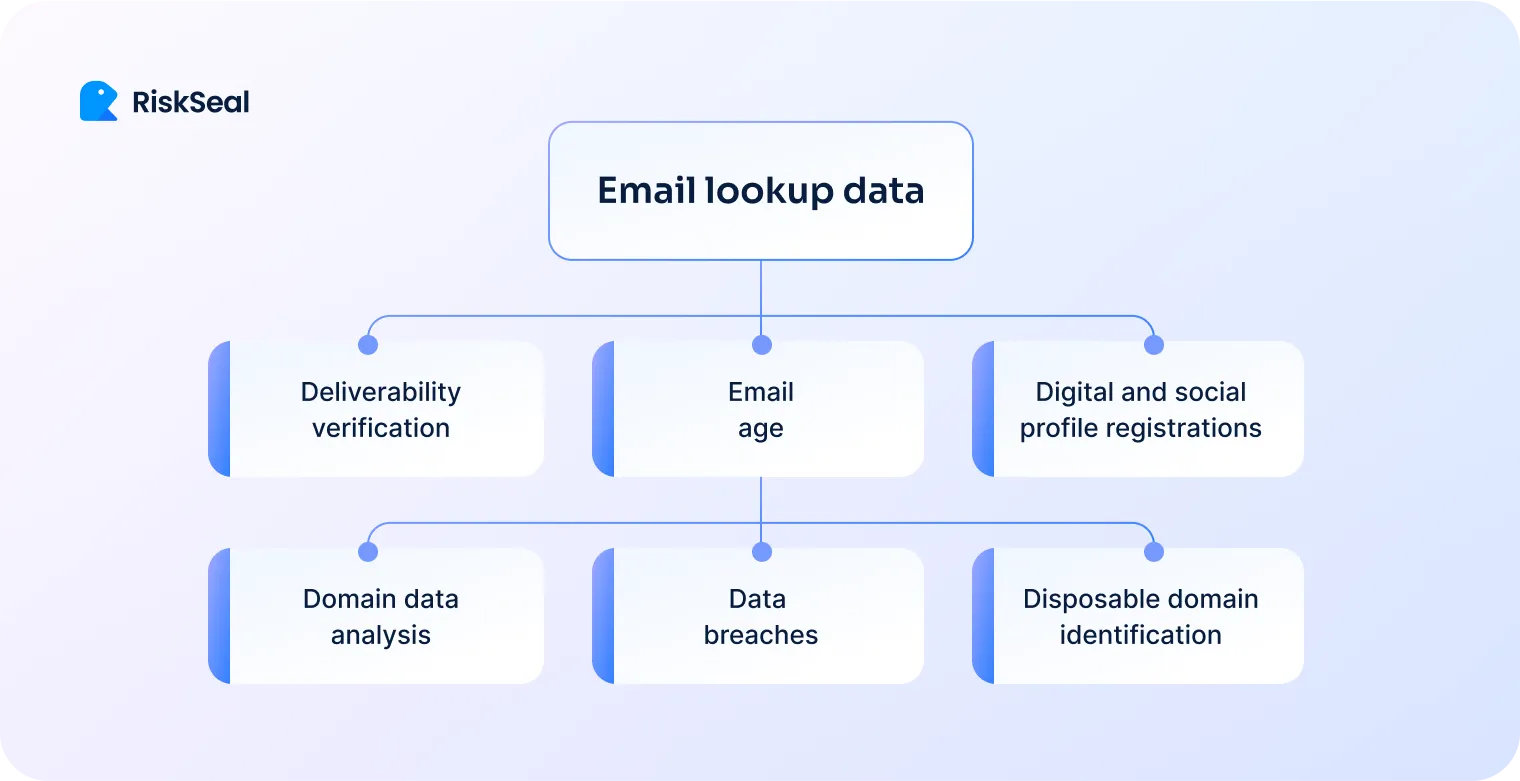

- Email data. By analyzing an applicant's email address, a lender can estimate its age, track online accounts registered with it, and detect any data breaches or spam-related activity.

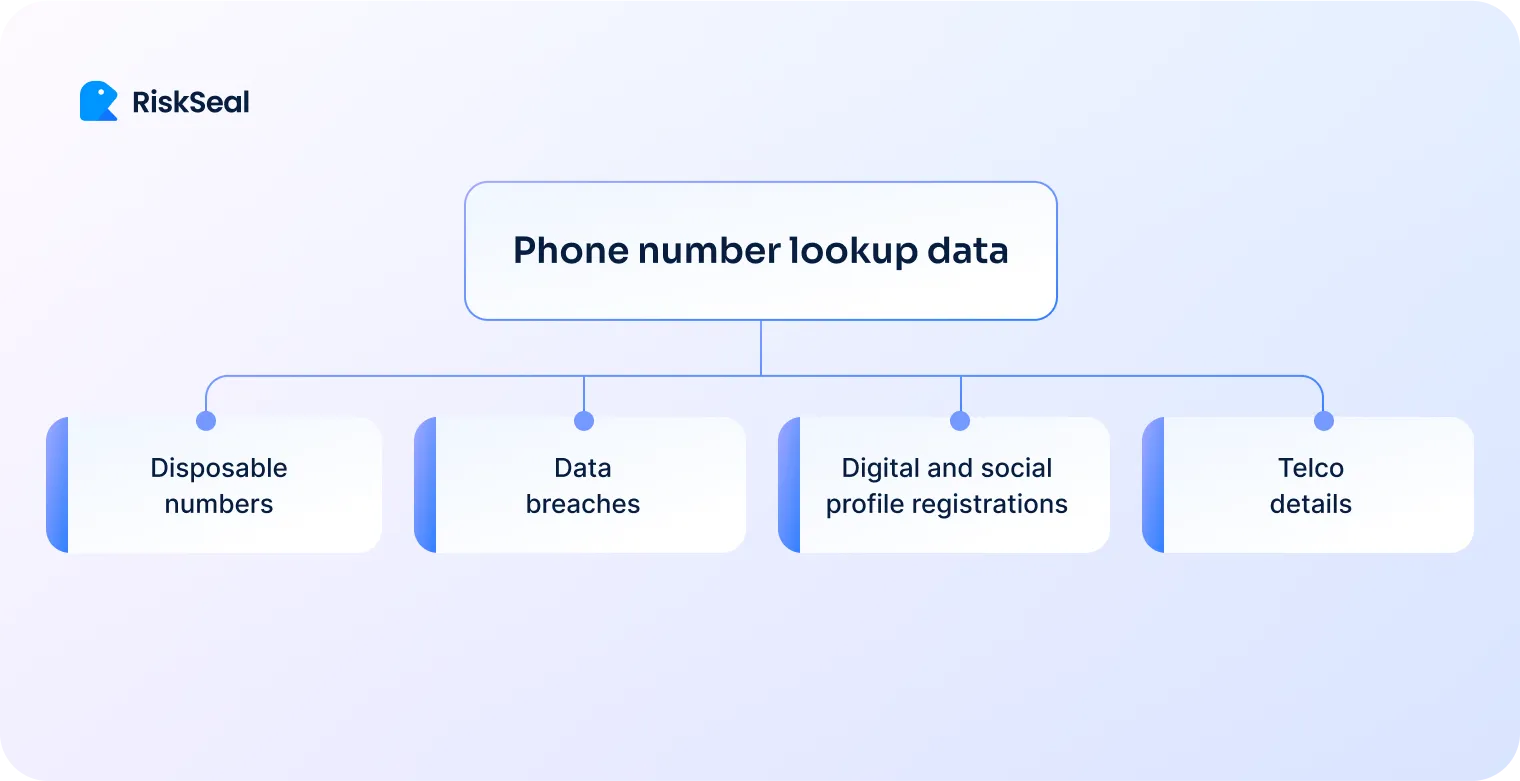

- Phone number data. This includes information about the mobile operator and the type of number (allowing the identification of temporary numbers, burner phones, or virtual SIM cards). It also enables tracking of the borrower's location via the carrier code and checking whether the number appears in high-risk databases.

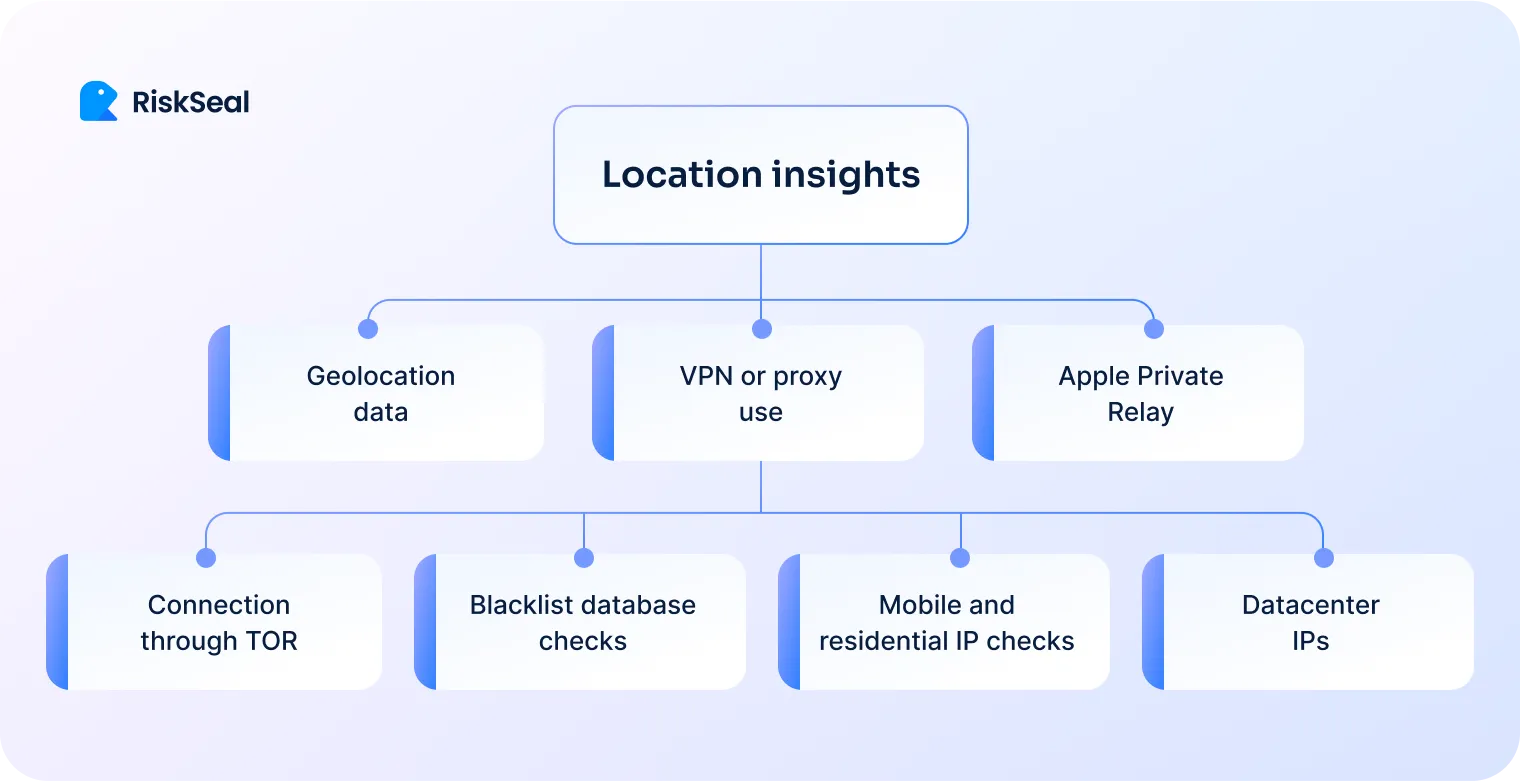

- IP address data. Analyzing an IP address helps determine a person's real geolocation and detect attempts to mask it. This can be indicated by the use of anonymizing tools such as VPNs, TOR, and similar services.

- Browsing behavior data. This includes information about the applicant's online activity, such as visited websites, online registrations, purchases on e-commerce platforms, and social media account activity.

Stage #2. Data enrichment

At this stage, the collected alternative data is integrated into the existing risk scoring model.

A modern data enrichment solution can optimize the credit scoring process by combining information from external fraud databases with data from non-traditional sources.

It has been proven that this approach delivers maximum efficiency:

The graph shows that combining traditional and alternative credit data allows for the most objective assessment of applicants.

Stage #3. Behavioral analysis

Advanced scoring systems are based on artificial intelligence (AI) and machine learning (ML). These technologies make it possible to track patterns in user behavior and detect anomalies.

This practice is known as behavioral analysis. Recent studies show that the accuracy of fraud detection using this method can reach 80%.

In addition to high accuracy, this approach has another significant advantage. ML models can learn in real time, adapting to constantly evolving fraud tactics.

Stage #4. Risk calculation

Based on predefined rules and threshold values, AI credit scoring assigns each applicant a risk score.

This is done using a risk scoring formula, which takes into account all the results of the conducted analysis.

After receiving a ready-made digital rating from an alternative data provider, the lender can proceed to the final stage of scoring credit risk.

Stage #5. Decision making

Depending on the received risk score, there can be several credit decisioning options:

- Approval of the loan issuance

- Flagging the borrower as suspicious for further verification

- Denial of credit

The creditworthiness assessment may influence the loan terms. A borrower deemed unreliable may be offered a less favorable interest rate or required to meet additional conditions, such as providing collateral or a guarantor.

The role of risk intelligence in credit scoring

Risk intelligence can significantly enhance credit scoring by analyzing historical data and real-time information about the borrower.

The system evaluates the applicant as soon as they submit their personal details, mobile phone number, and email address in the application.

This approach allows for a high-quality analysis while not disrupting the user experience.

Thanks to the quick processing, the potential borrower may not even be aware of the check being performed.

Another advantage of using risk intelligence in credit scoring is the reduction of costs for Know Your Customer (KYC) checks. The reason is that a digital credit scoring solution helps filter out most unreliable borrowers at the pre-KYC stage.

This is especially important considering that the average cost of a single KYC check in the financial sector exceeds $2,000:

Advanced techniques in risk scoring

Modern risk scoring systems apply several advanced techniques.

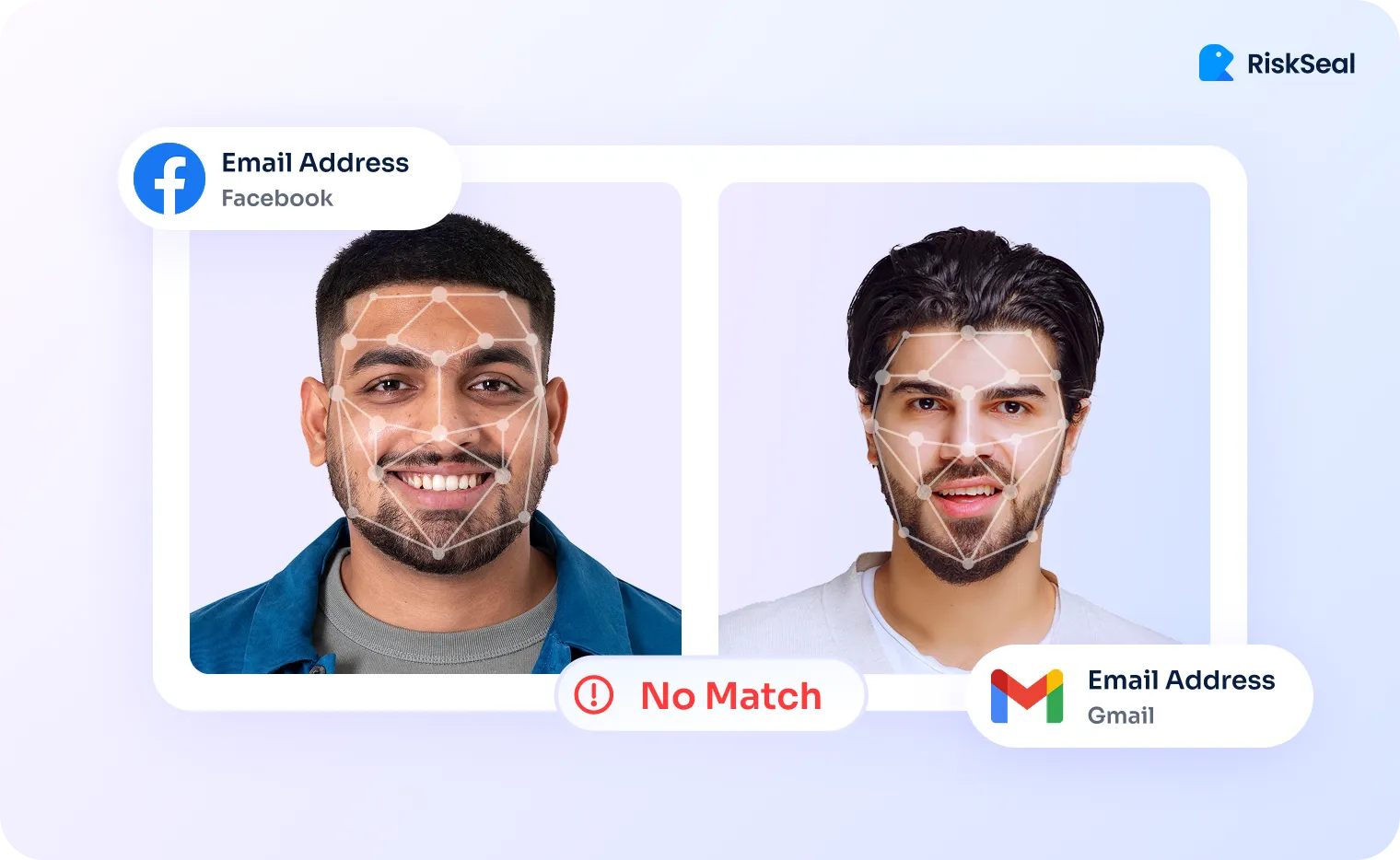

1. AI-powered image analysis. Platforms use a face recognition technique to identify the applicant’s identity.

Here’s how it works: the system compares the user's photos on social media. The borrower’s selfie may also be included in the comparison if it is required by the lending terms.

If discrepancies are found (e.g., the photos show different people), the borrower may be assigned a high-risk score.

2. Machine learning and predictive analytics. The application of machine learning for credit scoring means that risk models are continuously trained.

This allows the use of up-to-date data for analysis and more accurate default predictions.

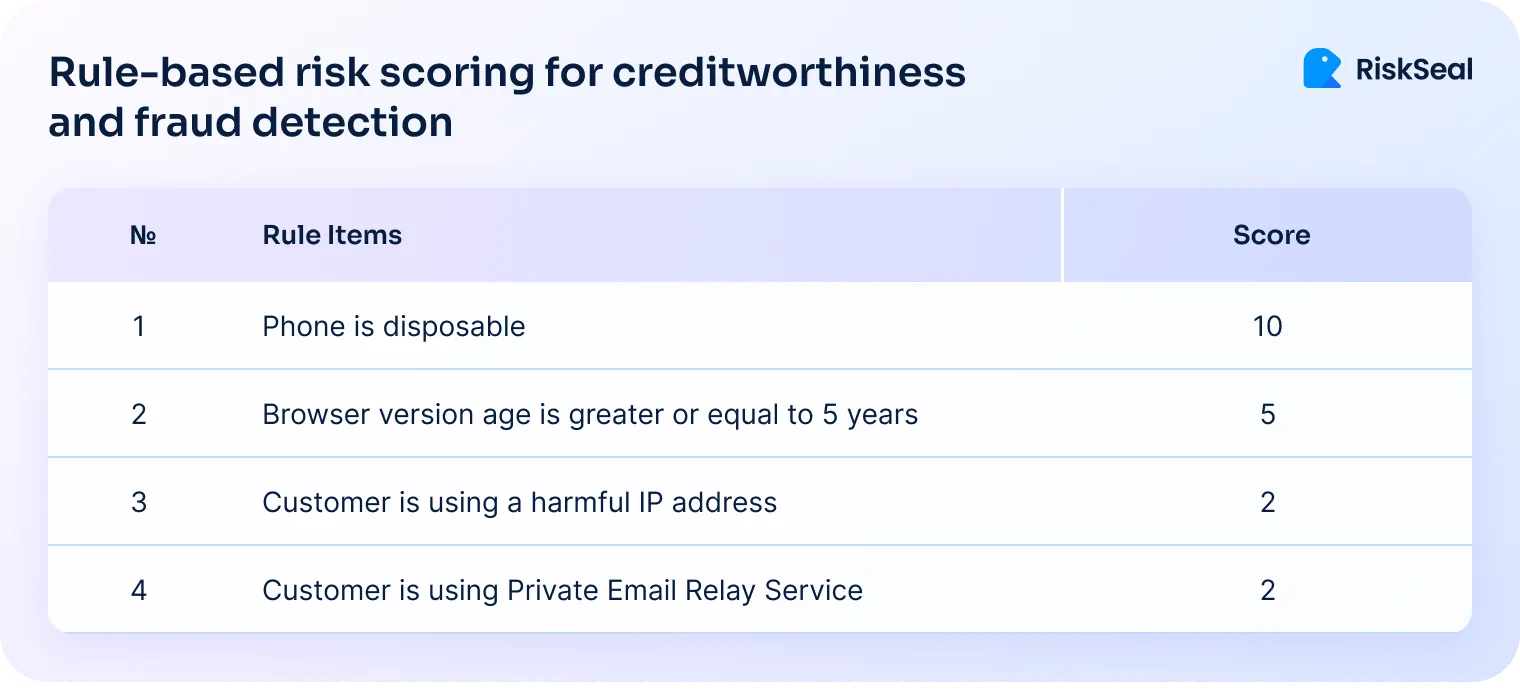

3. Rule-based engines. Lending organizations can create custom rules for assessing creditworthiness.

For example, a company might decide that a disposable phone number is the most convincing sign of fraud.

This is the approach used by one of the lenders who optimized the fraud detection model with the help of machine learning:

Digital Credit Scoring with RiskSeal

The AI-based RiskSeal scoring system helps lending organizations manage credit risks through a wide range of features:

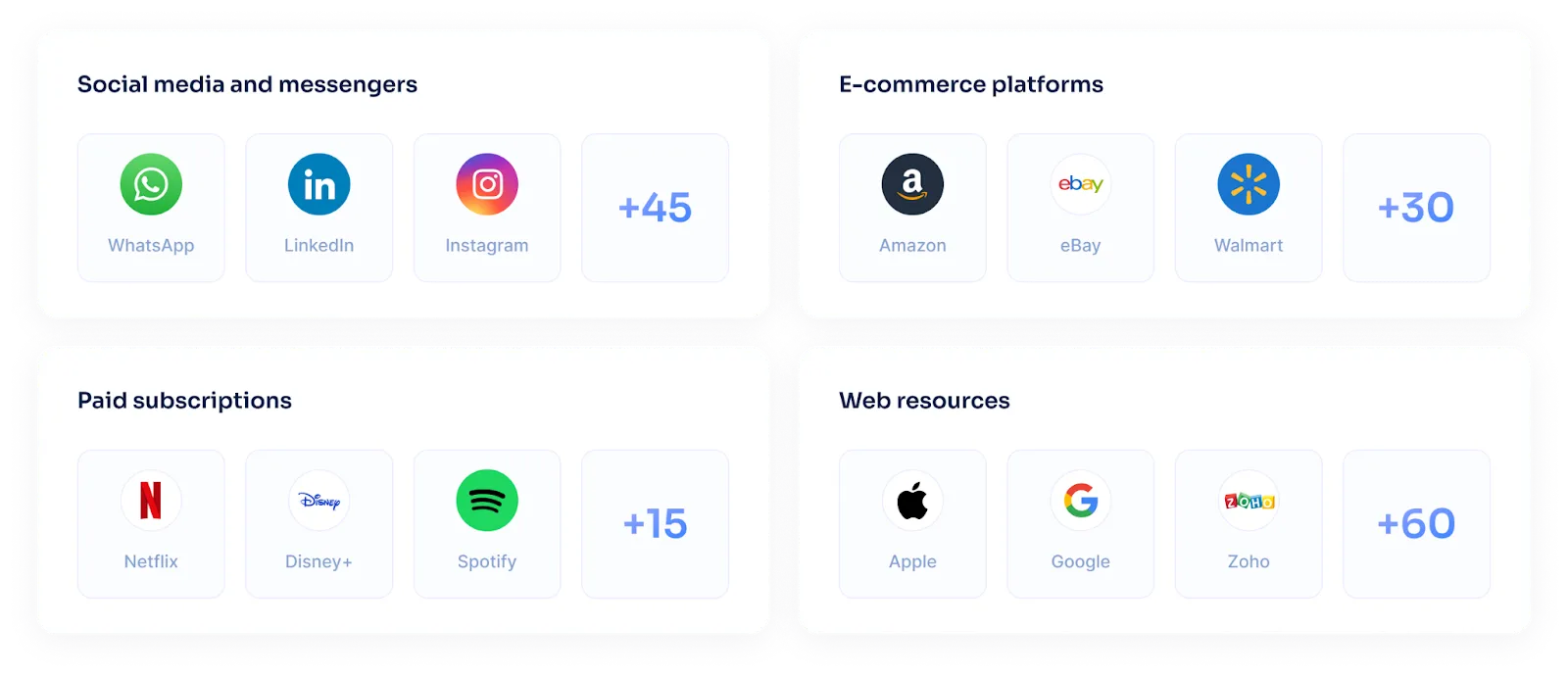

- Digital Footprint Analysis. The platform analyzes users' online activity on both global and local platforms. Based on the analysis, we provide our clients with more than 400 data points about a potential borrower.

This allows for a comprehensive understanding of the borrower's creditworthiness and helps detect fraudulent intentions on time.

- Ready-to-use Digital Credit Rating. Our clients receive a ready-made digital credit rating for the applicant. Based on this, the lender can make an informed decision about the advisability of granting the loan.

- Advanced identity checks. RiskSeal uses progressive technologies to verify the identity of applicants. These technologies ensure that the applicant is indeed who they claims to be.

The checks include:

Face match – detecting discrepancies in photos of the borrower posted across various sources (social media profiles and other online accounts, provided selfies).

Name match – checking the consistency of names across all of the applicant's online profiles. The advantage of RiskSeal is that the system takes into account different writing styles and languages. For instance, the names Maria, Mary, and Marie will be considered identical.

Location match – determining the actual location of the potential borrower and comparing the found data with the information provided in the application.

Want to improve the effectiveness of customer risk scoring in your credit institution? Contact RiskSeal experts and get a comprehensive consultation on all the platform's features.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

.svg)

.webp)