Top-10 Alternative Credit Scoring Platforms

Discover the top alternative credit scoring platforms that leverage alternative data for credit assessments.

.webp)

The traditional approach to assessing the creditworthiness of borrowers is no longer meeting the expectations of financial institutions.

According to Experian, 60 percent of them say they have to reject a significant proportion of loan applications due to insufficient data.

To solve the problem, lenders should turn to alternative data for credit scoring.

This article showcases some of the best credit knowledge tools from fintech startups. These help credit providers gain a clearer customer view and identify better opportunities.

Best alternative credit scoring startups: selection criteria

Here are the ten best digital credit scoring solutions that can improve the efficiency of credit assessment.

When selecting the best fintech tools for understanding credit, we focused on platforms that:

- Are specifically designed for the credit industry

- Integrate alternative data sources

- Offer a ready-to-use credit score

Through an in-depth analysis of the software market, we compiled a list of the top alternative credit scoring companies:

- RiskSeal

- Trusting Social

- CreditVidya

- Mobile Lending

- PayCrunch

- Creamfinance

- HomeCrowd

- Pulse API

- Mujeres WOW

- Juvo

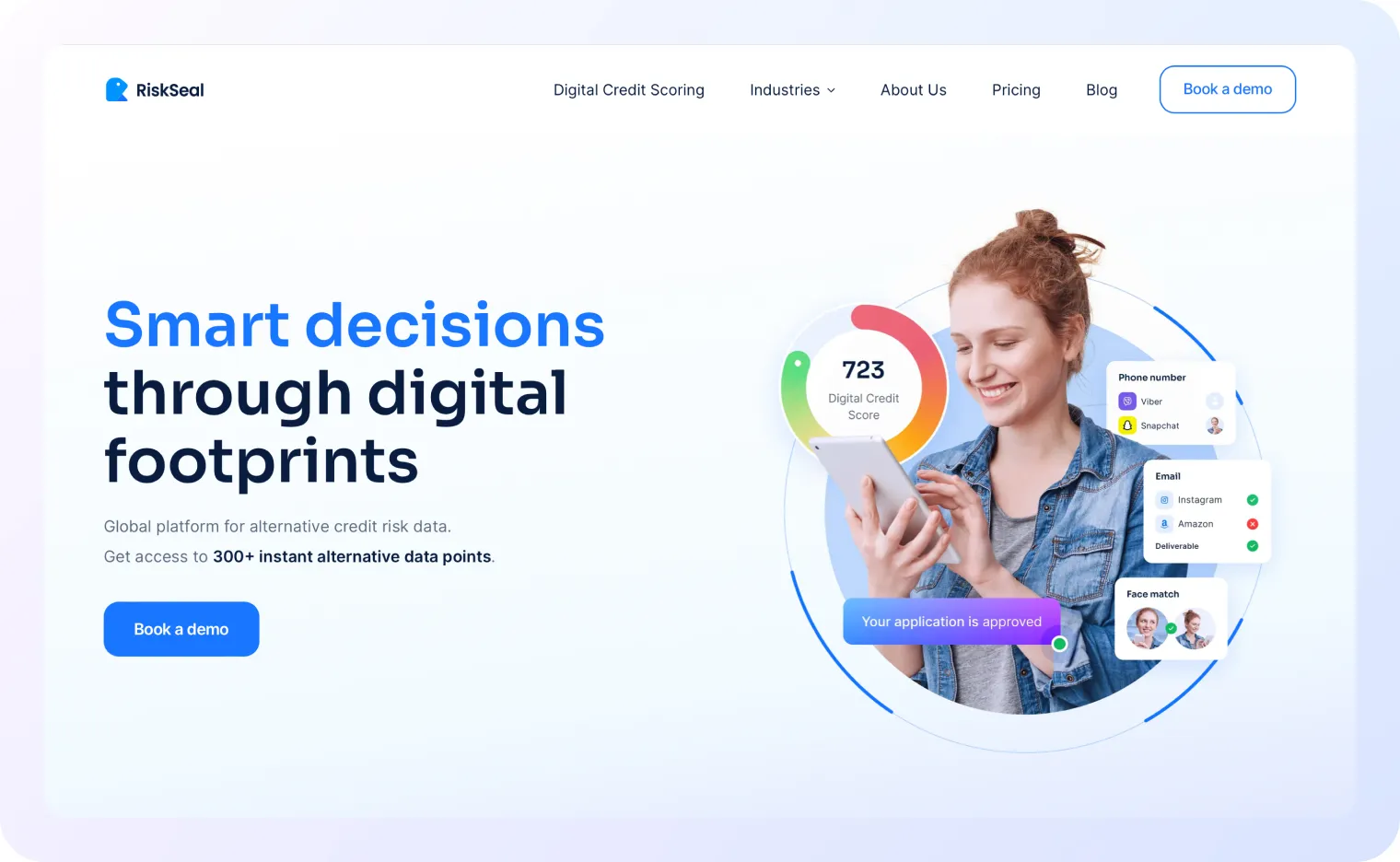

#1. RiskSeal – alternative credit scoring platform

RiskSeal is an advanced digital credit scoring system that leverages a wide range of alternative data for lenders.

By analyzing potential borrowers' digital footprints across more than 200 online platforms, RiskSeal enriches client scorecards with over 300 data points, providing a comprehensive view of borrower profiles.

These capabilities have made RiskSeal stand out and draw interest from fintechs with the best credit score features.

Founded: 2022

Country: USA / Poland

#2. Trusting Social – alternative data credit scoring tool

This is a platform based on artificial intelligence technology. Trusting Social is an AI-based platform for alternative data credit scoring. Its capabilities include alternative credit scoring and risk analytics.

To do this, Trusting Social uses advanced technologies such as Machine Learning and Big Data.

Founded: 2013

Country: USA

#3. CreditVidya – solution for credit scoring and risk assessment

CreditVidya is another of the digital credit scoring solutions focused on improving financial inclusion. For alternative credit scoring and assessing potential risks, the platform utilizes various unconventional data sources about applicants.

Founded: 2013

Country: India

#4. Mobile Lending – alternative credit scoring startup

Mobile Lending is a fintech company specializing in emerging markets. Leveraging alternative data sources for credit scoring such as mobile device usage patterns and transaction history, Mobile Lending’s platform offers a fresh approach to credit scoring, enabling more inclusive borrower evaluations.

Founded: 2018

Country: Netherlands

#5. Paycrunch – alternative credit scoring system

PayCrunch cannot be categorized as only alternative data provider. After all, it does not just provide non-traditional data but offers users a complete scoring system.

The platform allows you to draw conclusions about the creditworthiness of borrowers based on their patterns of behavior and transaction history. Focuses on Gen-Z consumers.

Founded: 2020

Country: India

#6. Creamfinance – alternative credit scoring company

Creamfinance is a fintech company that provides credit scoring alternative data and offers a variety of financial services, particularly personal lending. The platform uses advanced algorithms and a data-driven approach to assess creditworthiness and manage risk.

Founded: 2012

Country: Poland

#7. Homecrowd – credit scoring platform for mortgage lending

HomeCrowd platform uses alternative credit scoring to help people with limited financial means to purchase a home mortgage. It uses non-traditional data sources such as utility payment history, rent, or even social media activity. This opens up unbanked populations to mortgage lending.

Founded: 2019

Country: Malaysia

#8. Pulse API – solution for predicting borrower income

Pulse API is one of the alternative credit scoring companies that takes a unique approach to risk management. It allows lenders to predict an applicant's potential income. The platform analyses a person's employment information, including the type of employment, field of work, and other factors.

Founded: 2019

Country: USA

#9. Mujeres Wow – alternative credit scoring platform for women

.webp)

This is an AI-based solution whose goal is to improve credit availability for women. It uses non-traditional data to build credit profiles and increase the financial inclusivity of the target population. On the platform, women can rate each other according to social role, influencing credit accessibility.

Founded: 2019

Country: Mexico

#10. Juvo – alternative credit scoring tool

The platform uses alternative credit scoring models based on information about mobile usage. It creates its credit scores in partnership with mobile operators. This allows people without a traditional credit history to qualify for credit.

Founded: 2014

Country: USA

Benefits of adopting alternative credit scoring platforms

Alternative-data scoring platforms are emerging as some of the best fintech solutions for credit score management. They provide major benefits to lenders:

Expanded credit access and inclusion

Low financial inclusion is a critical issue around the world. In the U.S. alone, 19% of the population has no access to credit, being invisible or unscorable:

Pro tip: At RiskSeal, we tackle this challenge by leveraging alternative data sources for credit scoring. Our platform enables analysis on 98% of the global population, offering our clients access to over 300 data points for every applicant.

Enhanced prediction accuracy and risk management

Traditional credit scoring systems rely on historical financial data of the applicant. Due to their insufficiency and irrelevance, it can be difficult for lenders to make an objective credit decision.

Pro tip: Using RiskSeal, our clients significantly improve the predictive power of the scoring model through alternative data. Even without any credit bureau records, the best credit decision software can achieve an AUC of 83%.

Cost savings through automation and digital assessments

According to research, KYC verification of one customer can cost a financial organization from $1,500 to $3,000.

Pro tip: RiskSeal's alternative credit scoring saves from unnecessary costs. Only at the initial stage of borrower verification, our solution cuts off up to 70% of borrowers with clear signs of fraud or a high probability of default.

Another advantage of using RiskSeal is the full automation of the credit scoring process. With us, you will noticeably improve your customers' user experience. After all, we provide an answer on a credit application within 5 seconds.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

FAQ

What is an alternative credit scoring platform?

Alternative credit scoring platform is a digital solution for assessing a borrower's creditworthiness based on alternative data. Unlike traditional credit scoring systems, they are not limited to credit scores but rely on a wider range of information. They are often based on advanced technologies such as machine learning and artificial intelligence.

How does RiskSeal improve credit scoring with alternative data?

RiskSeal enriches its clients' scoring models with a large set of alternative data. The platform obtains this data by analyzing the digital footprint of potential borrowers left on 200+ local and global online resources.

What are the main benefits of adopting an alternative credit scoring platform?

The main benefits of adopting an alternative credit scoring platform include expanded credit access, enhanced prediction accuracy, and cost savings. These platforms can also improve the user experience by automating credit scoring and speeding up application decisions.

What are the best platforms for alternative credit scoring?

There is no single “best” platform for every lender.

The right choice depends on your organization’s needs. Including the markets you operate in, the level of risk you’re comfortable with, and the budget and resources available.

Some lenders prioritize depth of alternative data, while others focus more on ease of integration or specific use cases like fraud detection or thin-file scoring.

At RiskSeal, we design our scoring system to meet strict requirements for accuracy, transparency, and coverage. That way, we support a wide range of credit providers, especially those operating in emerging markets.

What is the best credit score API for fintech applications?

The best credit score API depends on several technical factors:

- the quality and freshness of data it provides

- how quickly it can process and return results

- the reliability of the underlying scoring logic

- how easy it is to integrate into an existing tech stack

Strong documentation and responsive support also matter, since interpreting alternative data and model outputs requires more than just an API call.

RiskSeal focuses on all of these areas, from data quality and real-time performance to developer-friendly integration. That’s how we help fintechs build accurate, scalable credit workflows.

.svg)

.webp)

.webp)