The Role of AI in Modern Credit Risk Management

Discover how AI is transforming credit organizations by enhancing risk management, fraud detection, and operational efficiency.

According to analysts at Allied Market Research, the market for artificial intelligence in banking was estimated at $3.88 billion just a few years ago.

Still, the same source predicts it will exceed $64 billion by 2030, a staggering 32% growth rate and the huge impact AI will have on the future of the fintech industry.

One of the financial processes that can be greatly optimized through artificial intelligence is credit risk management.

We at RiskSeal successfully implement explainable AI in our scoring system. Therefore, we decided to describe how this technology can benefit credit organizations.

The rise of AI in credit organizations

Artificial intelligence technologies are increasingly integrated into various operational processes within credit organizations.

According to Statista, in 2030 the profit from their use will amount to $301 billion, while in 2024 it will reach just over half of this amount – $164 billion.

For example, the use of NLP – Natural Language Processing – is widespread. According to Markets and Markets, the market size of NLP in the financial sector in 2023 barely exceeded $5 billion. By 2028, it is forecast to increase to $18.8 billion with a CAGR of 27.6%.

Lenders are no less widely using machine learning – it has also proven its effectiveness in the banking sector.

While AI in the financial industry was estimated to be worth $1.33 billion in 2021, this is projected to increase to $21.27 billion by 2031.

Use cases for AI in risk management

How can AI-based technologies be used in credit risk management?

The main use cases for them are as follows:

Use case #1. Forecasting financial risks and probability of default

Credit organizations can perform in-depth analyses based on extensive datasets. These include transaction histories, borrower's social media activity, and other unstructured data.

Use case #2. Fraud detection

Artificial intelligence can identify suspicious patterns in transactions in real time. Through continuous improvement, AI algorithms are increasingly able to distinguish fraudulent behavior from legitimate actions.

Use case #3. Operational risk assessment and management

The combination of AI-powered advanced data analytics enables financial institutions to automate the assessment of risks associated with business process errors, cyber threats, or third-party activities.

Use case #4. AI in loan portfolio monitoring

AI can analyze both historical and current loan data. Based on this analysis, AI finds patterns and improves risk predictions.

Use case #5. Stress testing

AI supports traditional scenario analysis by helping model how macroeconomic factors and lending performance affect each other.

For example, AI can find links between inflation and unemployment, and show how they impact the chance of loan defaults.

Use case #6. AI-driven customer segmentation

AI segments borrowers based on factors like behavior, age, and spending habits.

This helps lenders customize credit products for different types of borrowers.

The role of AI in credit risk management

AI has tremendous potential in credit risk management. It helps lenders optimize traditional risk models.

The use of AI in credit scoring and other forms of credit risk analysis has especially spread with the rise of fintech companies.

According to statistics, the AI market size in the fintech industry is estimated at $14.2bn and is forecast to grow to $76.2bn by 2033.

That is, the industry will demonstrate a CAGR of 20.5 percent.

Limitations of traditional credit risk models

Traditional banks and other lending institutions often rely on standard credit risk models based on historical data to evaluate a potential borrower.

These include:

- Credit rating

- Income level

- Employment history

- Applicant's current level of debt, etc.

This approach to credit risk management faces some limitations. One of them is the inability to extend credit facilities to unbanked individuals without credit history and traditional rating.

This problem is characterized by its global scale, affecting 1.4 billion people worldwide, with the greatest impact seen in developing countries.

For example, in Mexico, Nigeria, Egypt, and Morocco, more than 60 percent of the population is not covered by banking services.

Another limitation of traditional credit scoring is the one-sided assessment of the applicant.

Classic credit organizations take into account only historical financial data, which may lose its relevance at the time of the potential borrower's application to the lender.

Artificial intelligence and machine learning models make it possible to use a wider array of data. AI-powered alternative data credit risk solutions analyze behavioral information and other non-traditional signals like social media activity or online transactions.

This is key to making more accurate predictions and reducing the likelihood of default.

Challenges of implementing AI-based models

Despite the undeniable benefits, there are some challenges to implementing artificial intelligence in risk management processes.

The fact is that regulatory requirements impose credit risk models to be explainable and verifiable.

However, by their nature, most AI-based models are a “black box”. This makes it difficult to interpret the data generated from the analyses.

This state of affairs results in credit organizations continuing to rely on traditional models for risk assessment. On the other hand, AI is used to optimize certain aspects of these models.

How AI can help to stay compliant

AI helps credit institutions follow rules about data privacy, finance, technology, and more.

This works by automating compliance checks, making processes clearer, and supporting more responsible decisions.

Here are the main documents whose requirements a lender must consider:

European Union Artificial Intelligence Act (EU AI Act)

This document is intended to regulate AI systems based on risk categories: unacceptable, high, limited, and minimal.

For financial institutions, compliance with this law is more than relevant, since lending is classified as a high-risk use case for AI.

General Data Protection Regulation (GDPR)

This law was developed to protect the personal data of European Union citizens.

Compliance with GDPR finance requirements is also mandatory for banks and fintech companies, as lending involves the collection and processing of borrowers’ personal information.

U.S. OCC Guidance

This document aims to promote reliable and secure banking practices, particularly regarding the use of artificial intelligence and machine learning.

Credit institutions must follow the requirements of this guidance to ensure responsible use of AI in credit decision-making and risk modeling.

Use of AI in banking risk management

AI cannot completely replace traditional credit risk models. However, it is a technology widely used to improve them.

Here are some key ways to use artificial intelligence in banking and risk management.

AI credit modeling

Machine learning algorithms allow you to select variables that affect credit risk. To do this, AI-based models use alternative data sources to predict default risk more accurately.

This helps improve the performance of traditional models without violating regulatory requirements from regulators.

Model parameters optimization

Artificial intelligence can be used to tune the parameters of a credit risk model.

This allows you to more accurately identify the differences between high- and low-risk borrowers, improving predictive accuracy.

Risk assessment

By leveraging AI, non-traditional data sources can be integrated into credit scoring models, such as:

- Digital footprints (e.g., online behavior, browsing history)

- Purchasing patterns

- Social media activity

This approach is particularly useful in emerging markets or for lending to applicants with limited or no credit history, providing a more comprehensive view of creditworthiness.

Decision-making automation

Artificial intelligence enables the automation of the loan application process, significantly accelerating decision-making.

AI-based systems, including chatbots, can evaluate a borrower's creditworthiness in real-time by analyzing various data points.

These systems provide instant results, allowing for faster loan approvals and enhanced customer experience.

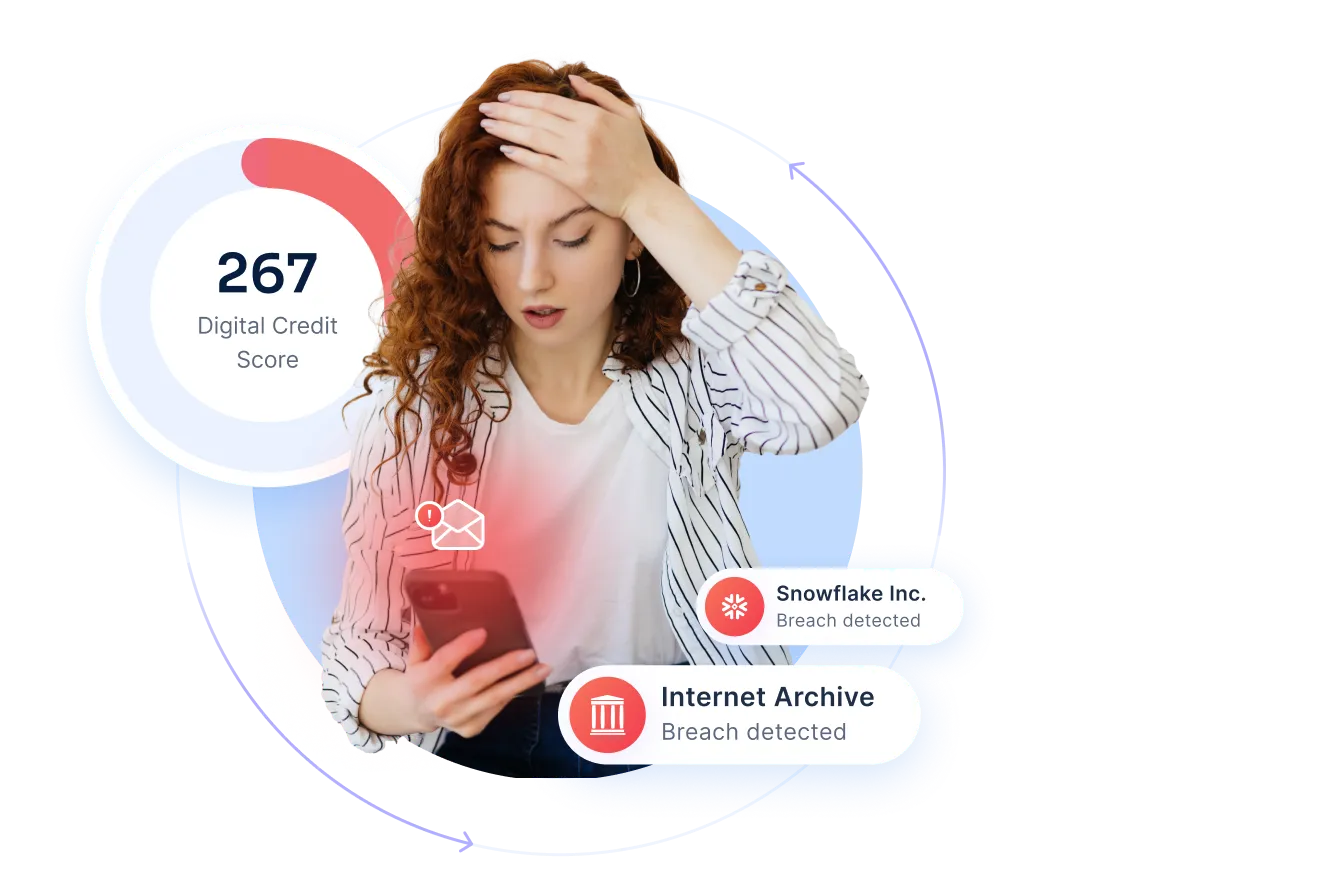

Dynamic credit scoring

Traditional credit scoring models primarily rely on static historical data, such as past loan repayment history or instances of delinquency.

In contrast, AI-based models utilize real-time data, allowing for continuous monitoring and updates of credit risk profiles. This approach to digital credit scoring gives lenders faster and more adaptive insights than legacy systems.

AI-based approach to risk management with RiskSeal

At RiskSeal, artificial intelligence plays a key role in several aspects of risk management.

We use advanced AI models to improve the accuracy, speed, and reliability of credit scores and fraud detection.

Here are three key use cases of AI at RiskSeal.

Face recognition

AI-powered face recognition technique is used to verify the identity of potential borrowers. It allows you to compare photos of an applicant across different online profiles and determine if they belong to the same person.

Facial recognition technology enables lenders to confidently verify an applicant’s identity, offering several key advantages:

Minimizing the risks of synthetic identity fraud. This type of fraud involves combining real and fake personal information to create a non-existent identity, which is then used for illegal activities. Facial recognition helps prevent this by verifying the applicant's true identity.

Optimizing the KYC (Know Your Customer) process:

1. Lenders can reduce the cost of the KYC procedure, as AI can detect fraudulent attempts early, eliminating the need for further verification of suspicious applicants.

2. Image comparison technology improves the accuracy and reliability of KYC results, ensuring greater security and compliance.

Name matching

RiskSeal enables lenders to compare the name on a loan application with various data sources using AI-driven name matching algorithms.

These algorithms can detect even the slightest discrepancies, helping identify potential fraud cases early.

Anomaly Detection

With AI, RiskSeal can analyze data patterns and detect deviations from typical user behavior.

These anomalies or irregularities in digital footprints can serve as early indicators of potential fraud, allowing prompt intervention.

The future of AI in credit risk management

AI is rapidly changing credit risk management, making processes faster and smarter. It will continue to be a major part of credit development in the future.

The challenge of explainability. One of the biggest issues with AI is making sure people understand how decisions are made. That’s why explainable AI in credit risk management is becoming a regulatory and business priority for forward-looking lenders. They want to ensure that AI systems are fair and clear in how they assess risk.

How RegTech can help. A solution to this challenge is RegTech—technology designed to help financial companies follow regulations more easily. RegTech can help credit organizations show how AI decisions are made, meeting regulatory demands for transparency.

Using white box and hybrid models. An alternative approach is to use 'white box' models, such as the one offered by RiskSeal.

Companies can also use hybrid models, which combine traditional methods with AI. This mix allows for both innovation and clarity, ensuring regulatory compliance.

The human-AI partnership in credit risk teams

AI cannot be considered a full-fledged alternative to a human. Rather, it expands the capabilities of analysts.

Let us examine the difference between the areas of responsibility of a human and artificial intelligence:

Credit institutions that combine AI and human effort can greatly improve their workflows. In these companies, the process works like this:

The human sets the direction → AI optimizes → the human checks and refines the result.

10 proven moves for deploying AI in credit risk assessment

AI can greatly boost the accuracy of credit risk assessment. But lenders need to make it usable, explainable, and auditable.

This list shows how to move from pilots to production while keeping regulators and stakeholders comfortable.

1. Choose models with explainability in mind

Start with models you can explain. Logistic regression or shallow tree-based models are easier to justify.

Use hybrids where complex models feed features into a simple decision layer. That keeps performance high and explanations clear.

2. Make features meaningful and auditable

Build features tied to real behaviors – email age, carrier type, device churn, subscription count.

Define each feature with data source, meaning, and owner. Store lineage so any score can be traced back to raw inputs.

3. Use post-hoc explainability tools

Apply SHAP or LIME for decision transparency. Limit outputs to the top three drivers per decision. Provide both local (per applicant) and global (model-wide) views.

Export them with the decision record for audits. Mind that banks often treat SHAP/LIME as supplements, not official “reasons for decline.”

4. Build model governance and documentation

Document model purpose, inputs, training window, validation results, and limits.

Log hyperparameters, feature engineering steps, and version history. Assign stewards to oversee reviews and regulatory interactions.

5. Validate thoroughly before rollout

Backtest and run out-of-time checks. Measure discrimination (AUC, KS), calibration (Brier, plots), and stability (PSI).

Test fairness and edge cases. Stress-test high-volume periods like Black Friday.

6. Monitor in production with clear alerts

Track business and model KPIs: default rates by band, score distribution shifts, PSI, false-positive and false-negative rates.

Trigger alerts when thresholds break. Log every decision for audit trails.

7. Keep a human in the loop

Automate high-confidence approvals. Route borderline cases to human review.

Provide analysts with short explanation cards – top drivers, recent behaviors, cross-lender patterns. Use feedback to retrain models.

8. Run continuous stress and scenario tests

Simulate inflation, rising unemployment, or loan stacking spikes.

Check how models react under shocks and peak volumes. Define safe thresholds and playbooks for intervention

9. Align with compliance and privacy

Map regulations to model design – explainability, data minimization, consent, fairness.

Keep audit-ready files for GDPR, LFPDPPP, LGPD, EU AI Act, and local banking rules. Bring in RegTech or credit risk assessment experts before scaling.

10. Measure impact with business metrics

Go beyond AUC. Report portfolio outcomes monthly: default rates by band, lift over bureau baselines, underserved coverage, fraud caught vs. missed.

Tie updates to collections cost savings and reduced manual review.

Pre-launch readiness checklist for risk managers

When you’re ready to move from design to deployment, a simple checklist keeps teams aligned and audits painless. Use this as a final gate before production.

- Feature definitions and lineage documented

- Local and global explainability enabled

- Backtest, OOT, and stress tests passed

- Governance owner assigned

- Monitoring dashboards and PSI alerts live

- Human review flows for borderline bands

- Legal/RegTech signoff complete

Treat this list as a living control sheet. Update it with lessons from monitoring and audits so every new model rollout gets smoother.

To summarize

AI-based technologies are transforming credit risk management by enabling financial organizations to automate processes, assess potential borrowers with greater accuracy, and detect fraud in real-time.

Despite regulatory constraints keeping traditional scoring models dominant in the current market, AI is increasingly being utilized to enhance their flexibility and performance.

RiskSeal is at the forefront of bringing innovative technology to the credit scoring process. The system uses AI to verify the identity of applicants, detect anomalies, and assess risk.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

Download Your Free Resource

Get a practical, easy-to-use reference packed with insights you can apply right away.

FAQ

How does RiskSeal apply AI in credit risk management?

RiskSeal applies explainable AI. We return data to our clients in the form of a formula that explains it. AI on the platform is used in three key industries: face recognition, name matching, and anomaly detection.

How is AI used in risk management?

AI in credit risk management is indispensable in optimizing traditional credit scoring models. This technology allows you to select variables that affect credit risk and adjust the parameters of the credit risk model.

AI is also used for risk assessment, decision automation, and dynamic credit risk monitoring.

What are the risks of artificial intelligence in financial services?

The main risks of using AI in finance include the difficulty of meeting regulatory requirements and ensuring the security of sensitive data.

Lenders can also face problems if they rely too much on AI models, which can be biased and reduce the role of human judgment.

What role does AI play in credit risk management?

Artificial intelligence can improve credit risk management processes. AI-based models can process large data sets and refer to alternative sources of information.

Among other things, they give lenders the ability to take into account consumer behavior, online transactions, and social media activity.

How do traditional credit risk models differ from AI-based models?

Traditional credit risk models rely on static historical data that may no longer be relevant at the time a loan application is processed. In addition, they are limited to financial information, which discourages lending to unbanked people.

AI-based models allow the use of alternative data that is updated in real-time. This helps to objectively assess the borrower and lend to people with no credit history.

What are the challenges of adopting AI-based models in credit risk management?

The implementation of AI-based models faces resistance from regulators. This is due to their “black box” nature – they are difficult to explain and interpret.

Because of this, artificial intelligence cannot become a full-fledged alternative to traditional credit risk management. The technology is only used to optimize it.

What are the future trends in AI for credit risk management?

The main trend in using AI for credit risk management is to develop interpretable and explainable AI models. For this purpose, it is advisable to implement RegTech solutions and create “white box” and hybrid models.

.svg)

.webp)

.webp)